Question on tax

I've just started work for the first time since I started my degree three years ago, so unfortunately I don't know my tax code or anything. I had to fill in a P46 if that helps.

I earn 17000 before tax, and that's ~13500 after tax. Am I right in thinking that that 13500 gets divided by 52 and then 5 to work out a daily amount? If so, I've worked 13 days, which would be 850 before tax and 675 after tax. I've been paid 825, so what's happened there?

Also, how does my tax year work? Say between now and April the 6th or whenever, I earn £9,999; will my tax-free earnings reset to 0 in April when the new tax year begins? Or does my tax year just begin and end from when I started working 3 weeks ago? I'm assuming it can't be the former, because I could earn 20k untaxed like that, and I'm sure the government won't be so forgiving.

Thanks for any help. I had a look online first but didn't really find anything.

I earn 17000 before tax, and that's ~13500 after tax. Am I right in thinking that that 13500 gets divided by 52 and then 5 to work out a daily amount? If so, I've worked 13 days, which would be 850 before tax and 675 after tax. I've been paid 825, so what's happened there?

Also, how does my tax year work? Say between now and April the 6th or whenever, I earn £9,999; will my tax-free earnings reset to 0 in April when the new tax year begins? Or does my tax year just begin and end from when I started working 3 weeks ago? I'm assuming it can't be the former, because I could earn 20k untaxed like that, and I'm sure the government won't be so forgiving.

Thanks for any help. I had a look online first but didn't really find anything.

Original post by J-SP

x

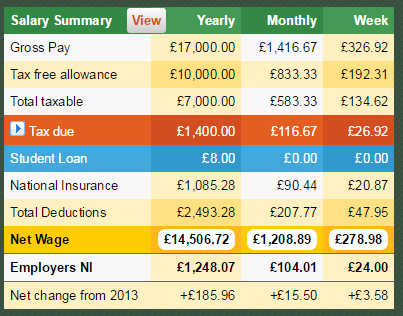

I just used an online tax calculator I found to try and figure it out. This is what it said:

But obviously that's for a full year, so it's not applicable to me.

Diving by 52.2 gets me a bit closer to the 825 I've been paid, but its around 845 instead of 850, so it's not much different.

I thought the 10k was also exempt from NI? If I use that chart to work out my NI for 1 day and then 13 days, it works out as around £50. Though, if we say I'm half way through the tax year and I thus pay half the NI I would in a year, that'd make it around £25 and explain the £25 missing from my pay. Think that's right?

Good to know it will reset, thanks for the info.

Quick Reply

Related discussions

- Student Finance Application

- Pff2 form, student finance wales

- Current year assessment

- Want to set up multiple businesses need help with tax etc

- Becoming registered keeper of car....

- Mazars school leaver apprenticeship UK.

- Taxes Question

- Twitch affiliate taxes as a 17 year old.

- International Student in UK, can I do affiliate marketing?

- Supply and Demand question with tax

- Tax code question

- Business TAX AAT

- A level economics

- Student finance - Parents current year income more than expected

- Help needed: Economics A-level question

- Student Finance and inheritance

- AQA A Level Economics Paper 2 (7136/2) -22th May 2023 [Exam Chat]

- AQA Economics paper 1

- how do i get a tax refund if i overpaid?

- Contact information for Tesco Payroll?

Latest

Last reply 1 minute ago

Government Social Research - Research Officer Scheme 2024Last reply 1 minute ago

Official London School of Economics and Political Science 2024 Applicant ThreadLast reply 2 minutes ago

Plymouth Marjon University - Your Questions AnsweredLast reply 2 minutes ago

CPS Pupillage/Legal Trainee Scheme 2024 (2025 Start)Last reply 4 minutes ago

TSR Study Together - STEM vs Humanities - Tenth SessionLast reply 5 minutes ago

Official University College London Applicant Thread for 2024Last reply 6 minutes ago

HSBC Degree Apprenticeship 2024Last reply 7 minutes ago

which unis will accept BBB for economicsLast reply 7 minutes ago

Official Cambridge Postgraduate Applicants 2024 ThreadLast reply 10 minutes ago

Edexcel GCSE Statistics Paper 2 Higher Tier (1ST0 2H) - 19th June 2023 [Exam Chat]Maths Exams

169

Trending

Last reply 1 minute ago

Government Social Research - Research Officer Scheme 2024Last reply 4 days ago

So I made the worst decision of my life. I chose Biochemistry as my degree.Last reply 6 days ago

Issues with jobs because I cannot driveTrending

Last reply 1 minute ago

Government Social Research - Research Officer Scheme 2024Last reply 4 days ago

So I made the worst decision of my life. I chose Biochemistry as my degree.Last reply 6 days ago

Issues with jobs because I cannot drive