OCR Accounting 2016

Starting a thread for OCR Accounting this year, AS or A2.

Did anyone just do F011 (unit 1) exam and think question 2 was ridiculously worded? And a 14 mark written question to top it off -_-

Did anyone just do F011 (unit 1) exam and think question 2 was ridiculously worded? And a 14 mark written question to top it off -_-

Scroll to see replies

Original post by ApnaPani

Does anyone remember what they got for depreciation in the manufacturing account for F013?

I got 37400 i think! What was your retained profit?

I got £315 , seems too low though

Original post by m_chatha

I got 37400 i think! What was your retained profit?

I got 37400 as well! I've totally forgotten what my answer was but your retained profit definitely rings a bell

i got 315 too! and 37400 for depreciation

Original post by chloeemily17

i got 315 too! and 37400 for depreciation

These guys may have forgot to take dividends off because it was in the trial balance and not additional information?

Original post by NathanTurner97

These guys may have forgot to take dividends off because it was in the trial balance and not additional information?

Yeah that sounds like the problem I hope we are right cause I was very confident on that question

Original post by thaopham

Has anyone got 12315 for q1?

I got this, and 227,315 for net/operating profit. I was debating whether they even wanted us to include dividends and transfers as it's a manufacturing account but I did it anyway as there's nothing to lose.

Original post by chloeemily17

Yeah that sounds like the problem I hope we are right cause I was very confident on that question

I got 12,315 and a lot of the other answers posted here end in 315 which means majority of our workings are correct to get that 315 ending, which means we get most marks. One of us along the line has miscalculated something which gives the difference of round thousands. I got the same depreciation. I took off the transfer and dividends.

Did you spot the loan interest owing?

Did you take away the increase in unrealised profit, I think the change was 1,500?

Can you think of any adjustments there were other than the obvious accruals/prepayments?

(edited 7 years ago)

Original post by sdfsddsf

Journal for application and allotment, Manufactoring A/C and Net cash flow are my bets

Well predicted, we were lucky they didn't throw the net cash flow in

An easy ratio question was nicer

An easy ratio question was nicerOriginal post by AGR3

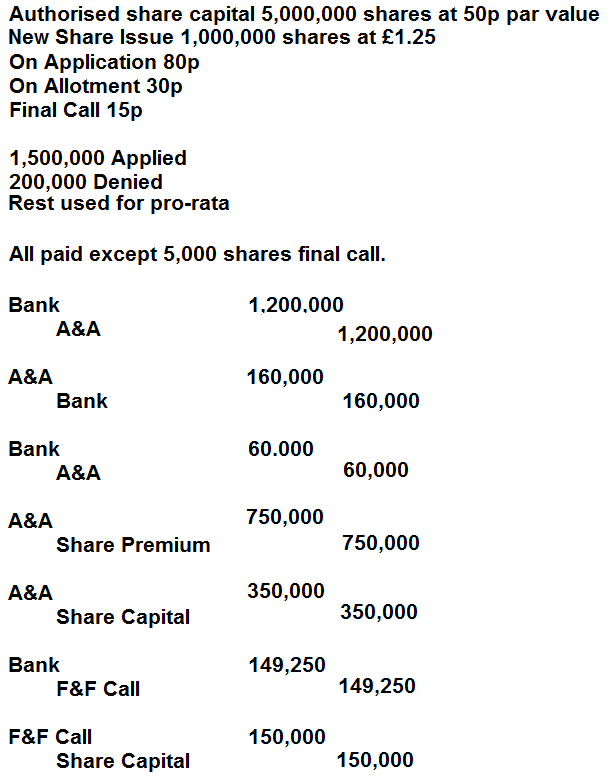

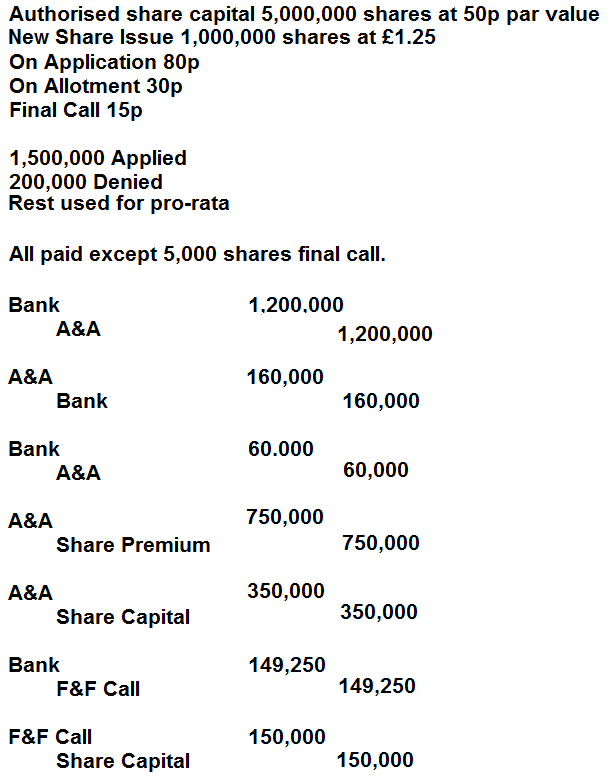

Question & Answer for Q3 Share Issue.

Can you get the answer for q1 too?

what did people do with the £60,000 of fixed asset that was brought in March. Did you do £240,000 less the £60,000 then less the provision for depreciation which I think was £68,000 then do the reducing balance 20%. Then do I think 3 months worth of depreciation on the £60,000. That would give you £25,400. Not taking the £60,000 out of the £240,000 would have given you a depreciation figure of £37,400. The difference is £12,000 which is why some people have got £315 or £12,315... depends what you did with the depreciation

(edited 7 years ago)

Quick Reply

Related discussions

- 1000+ A2-Level Biology Exam Questions

- OCR A GCSE Chemistry Paper 2 (Foundation Combined) J250/04- 13th June [Exam Chat]

- OCR GCSE Geography A Paper 1 (J383/01) - 22nd May 2023 [Exam Chat]

- OCR GCSE Geography B Paper 1 (J384/01) - 22nd May 2023 [Exam Chat]

- OCR A GCSE Biology Paper 1 (Higher Combined) J250/07- 16th May 2023 [Exam Chat]

- AQA Old spec computer-science papers

- AQA as level economics 2015 specimen paper 2

- OCR A GCSE Physics Paper 1 (Higher Combined) J250/11- 25th May 2023 [Exam Chat]

- OCR A GCSE Physics Paper 1 (Foundation Combined) J250/05- 25th May 2023 [Exam Chat]

- OCR A GCSE Chemistry Paper 1 (Foundation Combined) J250/03- 22nd May 2023 [Exam Chat]

- OCR A GCSE Biology Paper 1 (Foundation Combined) J250/01- 16th May 2023 [Exam Chat]

- OCR A GCSE Physics Paper 2 (Foundation Combined) J250/06- 16th June 2023 [Exam Chat]

- OCR A GCSE Chemistry Paper 1 (Higher Combined) J250/09- 22nd May 2023 [Exam Chat]

- OCR A GCSE Physics Paper 2 (Higher Combined) J250/12- 16th June 2023 [Exam Chat]

- OCR A GCSE Biology Paper 2 (Higher Combined) J250/08 - 9th June 2023 [Exam Chat]

- Maintenance loan

- OCR A GCSE Biology Paper 2 (Foundation Combined) J250/02- 9th June 2023 [Exam Chat]

- Looking for a study buddy

- How to take a backup of Office 365?

- Writing prompts in HK public exam

Latest

Trending

Last reply 4 days ago

Realistically how hard to become an accountant without a degree and just the AAT lvl?Last reply 1 week ago

Help - QMUL (PWC Flying Start) vs Bath (Accounting &Finance) vs UCL (IMB)Last reply 1 month ago

Durham BA Accounting and Finance Vs Bristol BSc FinanceLast reply 2 months ago

BSc Accountancy PwC Flying Start Queen Mary University of LondonTrending

Last reply 4 days ago

Realistically how hard to become an accountant without a degree and just the AAT lvl?Last reply 1 week ago

Help - QMUL (PWC Flying Start) vs Bath (Accounting &Finance) vs UCL (IMB)Last reply 1 month ago

Durham BA Accounting and Finance Vs Bristol BSc FinanceLast reply 2 months ago

BSc Accountancy PwC Flying Start Queen Mary University of London