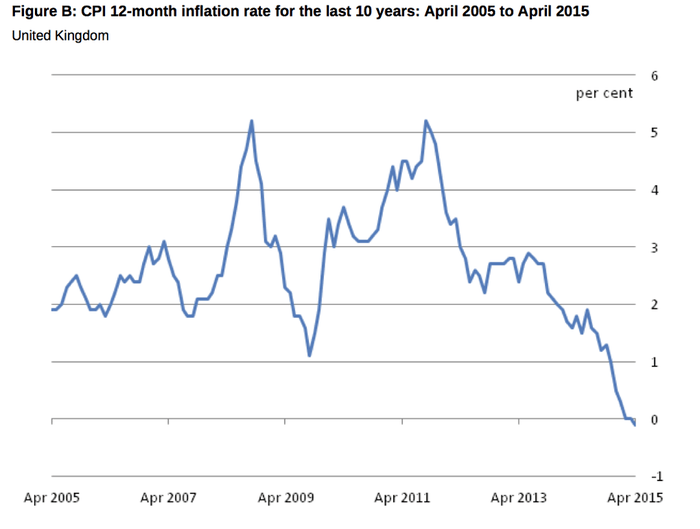

1960 - that was the last time prices actually declined.

Prices are down by 0.1% in April!

http://www.theguardian.com/business/2015/may/19/uk-inflation-turns-negative

The last time this happened was 1960.

Although this seems like good news, it might not be - deflation is a bad thing if it continues.

It might also be evidence that the economy is too sluggish and even contracting in reality.

http://www.theguardian.com/business/2015/may/19/uk-inflation-turns-negative

The last time this happened was 1960.

Although this seems like good news, it might not be - deflation is a bad thing if it continues.

It might also be evidence that the economy is too sluggish and even contracting in reality.

Scroll to see replies

Original post by Arkasia

So it's a bad thing if it keeps going up, a bad thing if it stagnates, and now it's a bad thing if it goes down?

The government just can't win, can they?

The government just can't win, can they?

Probably a modest level of inflation, say, 2% or around that figure, is healthy.

All of the experts think this is just a blip, but experts can be wrong and personally I think it's likely the economy is slowing down after a spurt. The general picture is that we are in one of the slowest and shallowest recoveries from a recession since records began and this latest figure tends to confirm that picture.

This is to be expected with fiat money.

Original post by Fullofsurprises

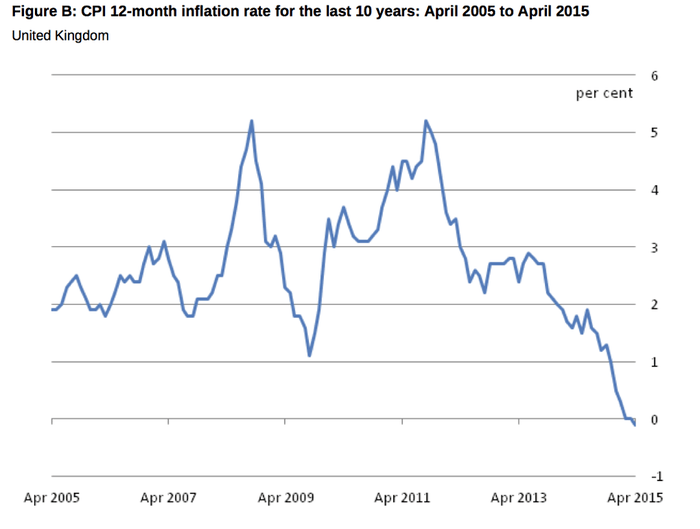

Prices are down by 0.1% in April!

http://www.theguardian.com/business/2015/may/19/uk-inflation-turns-negative

The last time this happened was 1960.

Although this seems like good news, it might not be - deflation is a bad thing if it continues.

It might also be evidence that the economy is too sluggish and even contracting in reality.

http://www.theguardian.com/business/2015/may/19/uk-inflation-turns-negative

The last time this happened was 1960.

Although this seems like good news, it might not be - deflation is a bad thing if it continues.

It might also be evidence that the economy is too sluggish and even contracting in reality.

Deflation is only really bad if it feeds into price expectations and people feel well off enough to save, the fact that we have so many issues probably means that won't occur. In addition it's mainly down to lower transport, fuel and food (due to transport) prices rather than demand driven.

Original post by Fullofsurprises

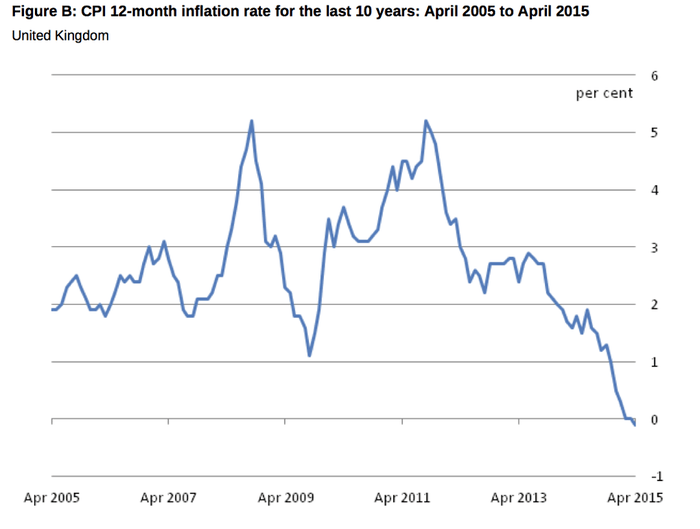

Probably a modest level of inflation, say, 2% or around that figure, is healthy.

All of the experts think this is just a blip, but experts can be wrong and personally I think it's likely the economy is slowing down after a spurt. The general picture is that we are in one of the slowest and shallowest recoveries from a recession since records began and this latest figure tends to confirm that picture.

All of the experts think this is just a blip, but experts can be wrong and personally I think it's likely the economy is slowing down after a spurt. The general picture is that we are in one of the slowest and shallowest recoveries from a recession since records began and this latest figure tends to confirm that picture.

This does not really confirm anything about the recovery, for the moment at least there's nothing really to suggest much of a slowdown in the economy and indeed cumulative growth is about on par with Germany since the recession now and well ahead of France but behind the US.

Though we do have some big issues which will cause problems down the line.

Original post by Arkasia

So it's a bad thing if it keeps going up, a bad thing if it stagnates, and now it's a bad thing if it goes down?

The government just can't win, can they?

The government just can't win, can they?

Not with people like Full of Suprises.

In fact if it's a labour government inflation, stagnation and deflation are all good according to her.

Original post by Fullofsurprises

Although this seems like good news, it might not be - deflation is a bad thing if it continues.

It might also be evidence that the economy is too sluggish and even contracting in reality.

It might also be evidence that the economy is too sluggish and even contracting in reality.

As long as my pay at least stays the same (and I'm getting a rise in Sept) it will continue to be good news for me.

Not really, oil went from $115 to $45, and is now at $65. Unless you expect us seeing $10 oil again there isn't much else to be said.

Original post by The_Mighty_Bush

This is to be expected with fiat money.

Sorry, deflation is to be expected with fiat money?

Original post by Quady

Sorry, deflation is to be expected with fiat money?

No, that's pretty obviously not what I meant.

That deflation is a rare thing and that constant, fairly rapid inflation is common is to be expected with fiat money.

What happened to all those people warning us that Quantitative Easing was the road to Mugabe economics and hyper inflation was just round the corner?

Or those right wing blogs telling us to buy gold because soon that would be the only thing left with value as western economies were finished...

Or those right wing blogs telling us to buy gold because soon that would be the only thing left with value as western economies were finished...

Original post by MagicNMedicine

What happened to all those people warning us that Quantitative Easing was the road to Mugabe economics and hyper inflation was just round the corner?

Or those right wing blogs telling us to buy gold because soon that would be the only thing left with value as western economies were finished...

Or those right wing blogs telling us to buy gold because soon that would be the only thing left with value as western economies were finished...

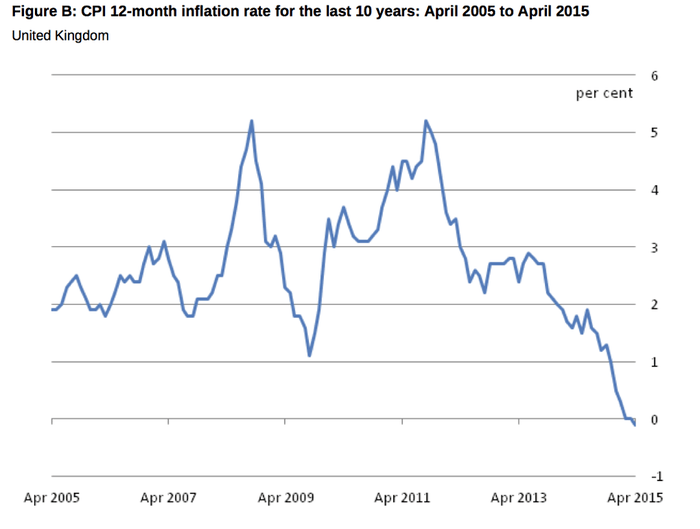

The big central bankers have been slugging away with QE and fighting currency wars mainly because of massive deflationary pressures. Despite all the efforts since 2008, bank lending and credit have generally not recovered as well as they should. The world is stuck in a 1920s/30s-style competitive devaluation and deflation and it's going to get much worse. What we're seeing now is what happens when they turn the QE taps off and start to try to return to realism. Unfortunately, the reality is not very nice.

Original post by Fullofsurprises

The big central bankers have been slugging away with QE and fighting currency wars mainly because of massive deflationary pressures. Despite all the efforts since 2008, bank lending and credit have generally not recovered as well as they should. The world is stuck in a 1920s/30s-style competitive devaluation and deflation and it's going to get much worse. What we're seeing now is what happens when they turn the QE taps off and start to try to return to realism. Unfortunately, the reality is not very nice.

Simple solution.

Massive housebuilding programme all financed by government borrowing.

Central bank purchase all the excess government bonds with newly created money, in fact get the central bank to purchase all outstanding government debt and write it off, with newly created money.

Result a large and permanent increase in the money supply.

Exchange rate of the pound will plummet helping exporters.

Deflation will be averted.

Original post by MagicNMedicine

Simple solution.

Massive housebuilding programme all financed by government borrowing.

Central bank purchase all the excess government bonds with newly created money, in fact get the central bank to purchase all outstanding government debt and write it off, with newly created money.

Result a large and permanent increase in the money supply.

Exchange rate of the pound will plummet helping exporters.

Deflation will be averted.

Massive housebuilding programme all financed by government borrowing.

Central bank purchase all the excess government bonds with newly created money, in fact get the central bank to purchase all outstanding government debt and write it off, with newly created money.

Result a large and permanent increase in the money supply.

Exchange rate of the pound will plummet helping exporters.

Deflation will be averted.

Surprises me how persistent governments are with QE. It has it's merits but it has been way over done, its effect on asset prices and making the rich richer is ridiculous. So often government seems determined to exacerbate inequality. More ambitious and unorthodox monetary and fiscal policy has never really been properly considered.

Original post by MagicNMedicine

Simple solution.

Massive housebuilding programme all financed by government borrowing.

Central bank purchase all the excess government bonds with newly created money, in fact get the central bank to purchase all outstanding government debt and write it off, with newly created money.

Result a large and permanent increase in the money supply.

Exchange rate of the pound will plummet helping exporters.

Deflation will be averted.

Massive housebuilding programme all financed by government borrowing.

Central bank purchase all the excess government bonds with newly created money, in fact get the central bank to purchase all outstanding government debt and write it off, with newly created money.

Result a large and permanent increase in the money supply.

Exchange rate of the pound will plummet helping exporters.

Deflation will be averted.

Can't say i'm a massive fan of constantly weakening the currency although QE should continue so long as we have a deficit and GILTS are not trading at negative real yields. Though it seems i'm a minority in terms of wanting a strong pound.

Well, I'm certainly feeling the impact of deflation. Off-peak train fares where I live have just been hiked 35% and house price growth is around 10%. Our Satellite TV also went up about 5% amongst other things. Okay, this is very specific. But as someone else said, the perception amongst the public is that inflation is very high, not deflating. And therefore, deflation in this context is an extremely good thing because it compensates for high inflation in specific areas.

Posted from TSR Mobile

Posted from TSR Mobile

Original post by will2348

Well, I'm certainly feeling the impact of deflation. Off-peak train fares where I live have just been hiked 35% and house price growth is around 10%. Our Satellite TV also went up about 5% amongst other things. Okay, this is very specific. But as someone else said, the perception amongst the public is that inflation is very high, not deflating. And therefore, deflation in this context is an extremely good thing because it compensates for high inflation in specific areas.

Posted from TSR Mobile

Posted from TSR Mobile

Off peak prices where I am were frozen this year and will be for the next two years.

Just had a circa 5% cut in my tv/phone/broadband package.

House prices I'm not too sure on, more like a 5% rise I think.

Original post by will2348

Well, I'm certainly feeling the impact of deflation. Off-peak train fares where I live have just been hiked 35% and house price growth is around 10%. Our Satellite TV also went up about 5% amongst other things. Okay, this is very specific. But as someone else said, the perception amongst the public is that inflation is very high, not deflating. And therefore, deflation in this context is an extremely good thing because it compensates for high inflation in specific areas.

Posted from TSR Mobile

Posted from TSR Mobile

It will be the cost of fuel more than anything that has brought the RPI down. As you say, many other costs have risen. Food prices are said to be static or declining, because of the alleged levels of competition amongst the supermarkets, but I think in reality they have simply dropped the quality and size of many common brands to compensate.

The press are carrying a number of articles at the moment about the drop in middle class living standards in particular - a lot of middle class salaries have fallen in real terms and many of the things regarded as integral to a middle class way of life have risen sharply in price.

Original post by Rakas21

Can't say i'm a massive fan of constantly weakening the currency although QE should continue so long as we have a deficit and GILTS are not trading at negative real yields. Though it seems i'm a minority in terms of wanting a strong pound.

Your apparent complacency is ill-founded. QE is effectively a currency devaluation tool, but as everyone that matters has been quantitativating (not sure that's a word

), the net result has been a currency war of competitive devaluations, just like in the Hooverite era of the Great Depression. Overall demand remains sluggish, bank credit is still stuck and real growth has not regained the lost ground of the crash. As Stiglitz pointed out yesterday, "GDP per capita in the UK is lower than it was before the crisis. That is not a success".

), the net result has been a currency war of competitive devaluations, just like in the Hooverite era of the Great Depression. Overall demand remains sluggish, bank credit is still stuck and real growth has not regained the lost ground of the crash. As Stiglitz pointed out yesterday, "GDP per capita in the UK is lower than it was before the crisis. That is not a success".

http://www.theguardian.com/books/2015/may/24/joseph-stiglitz-interview-uk-economy-lost-decade-zero-growth

Quick Reply

Related discussions

- Down With Love (2003) - better than Barbie!!!

- Vinted

- Edexcel A Level History American Dream Essay

- Is it possible to buy a house before it is valued and then sell it after valuation?

- AQA Alevel geography NEA help

- Anyone heard back from Ulster Uni after online interviews?

- What to do

- Edexcel History A Level option 1F In search of the American dream

- What is studying in Edinburgh like?

- Confused about giving uni interview

- Why are people mad at others for not finding them attractive?

- Guide: Getting out of an unconditional offer and applying through Clearing

- Blackbox in an automatic first car

- loughborough vs lancaster for computer science

- Communication at Sheffield Hallam University

- Urgent clearing advice

- AQA History coursework HELP!!!

- URGENT - IGCSE History 16 marker

- Marking Criteria

- What if my predicted grades are lower than what I will achieve?

Latest

Last reply 12 minutes ago

Official University of Edinburgh Applicant Thread for 2024Last reply 23 minutes ago

Official UCL Offer Holders Thread for 2024 entryPosted 52 minutes ago

Should I accept my offer at LCF or wait another year and apply for CSM again?Last reply 1 hour ago

Virgin/O2 Technology Placement - Virtual Assessment and embarrassing questionLast reply 1 hour ago

Official London School of Economics and Political Science 2024 Applicant ThreadLast reply 1 hour ago

What games did everybody play on their computers at school or when they were youngerGaming

11

Trending

Last reply 12 hours ago

Why is the political left now censorious and authoritarian??Last reply 15 hours ago

Is it true that British unis are prejudiced towards degrees from Scottish unis?Last reply 18 hours ago

If the Russell Group was now a fair representation of what it still claims to beLast reply 1 week ago

TSR Goes Green: How important will the environment be in this year's election?Last reply 2 weeks ago

Research Rankings of universities if you add Research Quality & Intensity percentagesLast reply 1 month ago

Is University of Birmingham prestigious and respected well enough in UK ?Trending

Last reply 12 hours ago

Why is the political left now censorious and authoritarian??Last reply 15 hours ago

Is it true that British unis are prejudiced towards degrees from Scottish unis?Last reply 18 hours ago

If the Russell Group was now a fair representation of what it still claims to beLast reply 1 week ago

TSR Goes Green: How important will the environment be in this year's election?Last reply 2 weeks ago

Research Rankings of universities if you add Research Quality & Intensity percentagesLast reply 1 month ago

Is University of Birmingham prestigious and respected well enough in UK ?