Post Your Economics Question Here

Scroll to see replies

alex_hk90

I was under the impression that it is exactly the same as a fixed rate (within a certain band). So when the exchange rate for the other currency falls through the floor, the central bank of that country will buy up some of the currency (using reserves of dollars or gold) to shift demand to the right and bring the price back up above the floor. And when the exchange rate for the other currency rises above the ceiling, the central bank will sell the other currency (buying dollars and adding to its reserves).

As for the effect it has, I'll need to think about it a bit.

As for the effect it has, I'll need to think about it a bit.

Right ok I see, so as the dollar is falling, these oil countries are having to buy more of their own currency using the dollar reserves they have? From the articles I've read it reduces their oil revenue, is this perhaps because some of the revenue they get from oil (which is in dollars right?) is now having to be used to buy back their currency?

El Mariachi

Right ok I see, so as the dollar is falling, these oil countries are having to buy more of their own currency using the dollar reserves they have? From the articles I've read it reduces their oil revenue, is this perhaps because some of the revenue they get from oil (which is in dollars right?) is now having to be used to buy back their currency?

I would have thought that the dollar falling would mean that the other currencies would rise. They would have to sell their currency (shifting supply out) to keep the exchange rate under the ceiling. This would mean that their dollar reserves would be rising. I'm still not sure what effect it has on oil revenues (which would be received in dollars).

Hopefully someone who's a bit more comfortable with this can explain it better.

alex_hk90

I would have thought that the dollar falling would mean that the other currencies would rise. They would have to sell their currency (shifting supply out) to keep the exchange rate under the ceiling. This would mean that their dollar reserves would be rising. I'm still not sure what effect it has on oil revenues (which would be received in dollars).

Hopefully someone who's a bit more comfortable with this can explain it better.

Hopefully someone who's a bit more comfortable with this can explain it better.

Yeah, thanks for trying though

El Mariachi

Right ok I see, so as the dollar is falling, these oil countries are having to buy more of their own currency using the dollar reserves they have? From the articles I've read it reduces their oil revenue, is this perhaps because some of the revenue they get from oil (which is in dollars right?) is now having to be used to buy back their currency?

No, because buying more domestic currency would cause it to rise against the dollar. They want the opposite. So alex is right in saying that when the domestic currency appreciates against the dollar, the govt/central bank will buy up dollars and sell domestic currency to maintain the peg.

As for oil revenues, its in dollars. Dollars are worth less today = revenues are worth less. In the end, they have to convert these dollar revenues to domestic currency to spend them right?!

CorpusNinja

As for oil revenues, its in dollars. Dollars are worth less today = revenues are worth less. In the end, they have to convert these dollar revenues to domestic currency to spend them right?!

That's the conclusion I just came to.

It's the direction that the exchange rate of the dollar is going in that matters.

If you sold 1 gallon of oil yesterday for $100 (which was worth £50), but today $100 is only worth £45, then the value of your oil revenue has fallen.

02mik_e

What diagrams would i draw for this question:

Evaluate the economic case for and against the UK government further increasing tax on tobacco in order to reduce smoking.

Thanks

Evaluate the economic case for and against the UK government further increasing tax on tobacco in order to reduce smoking.

Thanks

Well first of all tobacco is a demerit good so you want a fairly inelastic demand. an increase in tax will increase the cost of production for firms so you should shift the supply curve to the left from the original market equilibrium. this should lead to a large increase in price of tobacco and a small decrease in demand.

CorpusNinja

No, because buying more domestic currency would cause it to rise against the dollar. They want the opposite. So alex is right in saying that when the domestic currency appreciates against the dollar, the govt/central bank will buy up dollars and sell domestic currency to maintain the peg.

As for oil revenues, its in dollars. Dollars are worth less today = revenues are worth less. In the end, they have to convert these dollar revenues to domestic currency to spend them right?!

As for oil revenues, its in dollars. Dollars are worth less today = revenues are worth less. In the end, they have to convert these dollar revenues to domestic currency to spend them right?!

Yeah, obviously

Lol, thanks.

Lol, thanks."Using supply and demand diagrams to illustrate your answer, and making clear your assumptions, examine the effects of the expansion of the cultivation of biofuels on the price of food. Give a full explanation of how you arrive at the answer you give."

Hi, I'm in my first year of University and this is my first essay question I've ever done for my course. I was wondering anyone could give me any advice on what should be included? I've written the essay itself, but I'm not overly sure if I've included the right material.

It's 1000 words.

Hi, I'm in my first year of University and this is my first essay question I've ever done for my course. I was wondering anyone could give me any advice on what should be included? I've written the essay itself, but I'm not overly sure if I've included the right material.

It's 1000 words.

I'm having a little trouble getting the technique right on the last questions for the OCR Development paper (Unit 2886), especially part a).

Explain why some countries, such as Zambia, have a saving ratio of about 5% whilst the ratio in other countries, such as South Korea, is over 30%. (10)

The ones I have the most trouble with are the ones where you have to explain the way that developing countries are so different when it comes to different aspects of development (i.e. economic development, HDI, HPI).

Do you just list a load of ways they are different/have a different savings ratio and then elaborate on how and why?

Explain why some countries, such as Zambia, have a saving ratio of about 5% whilst the ratio in other countries, such as South Korea, is over 30%. (10)

The ones I have the most trouble with are the ones where you have to explain the way that developing countries are so different when it comes to different aspects of development (i.e. economic development, HDI, HPI).

Do you just list a load of ways they are different/have a different savings ratio and then elaborate on how and why?

An economy is operating on it's PPF. If the output of capital goods is increased then the output of consumer goods will

A) Increase in the short run, but decrease in the short run.

B) Decrease in the short run, increase in the long run

C) Increase in the short run and increase in the long run

D) Decrease in the short run and decrease in the long run

I think it's B, as the country will have to spend a lot of it's resources on investing and capital, but in the long run this means it can produce more. Can anyone confirm? Thanks

A) Increase in the short run, but decrease in the short run.

B) Decrease in the short run, increase in the long run

C) Increase in the short run and increase in the long run

D) Decrease in the short run and decrease in the long run

I think it's B, as the country will have to spend a lot of it's resources on investing and capital, but in the long run this means it can produce more. Can anyone confirm? Thanks

Vesta

An economy is operating on it's PPF. If the output of capital goods is increased then the output of consumer goods will

A) Increase in the short run, but decrease in the short run.

B) Decrease in the short run, increase in the long run

C) Increase in the short run and increase in the long run

D) Decrease in the short run and decrease in the long run

I think it's B, as the country will have to spend a lot of it's resources on investing and capital, but in the long run this means it can produce more. Can anyone confirm? Thanks

A) Increase in the short run, but decrease in the short run.

B) Decrease in the short run, increase in the long run

C) Increase in the short run and increase in the long run

D) Decrease in the short run and decrease in the long run

I think it's B, as the country will have to spend a lot of it's resources on investing and capital, but in the long run this means it can produce more. Can anyone confirm? Thanks

I also think it's B.

Vesta

One more please

One of the main functions of the price mechanism in a free market economy is to:

A) provide free goods

B) ration scarce goods

C) ensure that incomes are evenly distributed

D) keep prices stable

pleaaaaaaaaaaaaase

I think it's B but I dont know why and how I got that

One of the main functions of the price mechanism in a free market economy is to:

A) provide free goods

B) ration scarce goods

C) ensure that incomes are evenly distributed

D) keep prices stable

pleaaaaaaaaaaaaase

I think it's B but I dont know why and how I got that

Again, I also think it's B.

The price mechanism rations scarce goods to reflect conditions in supply and demand.

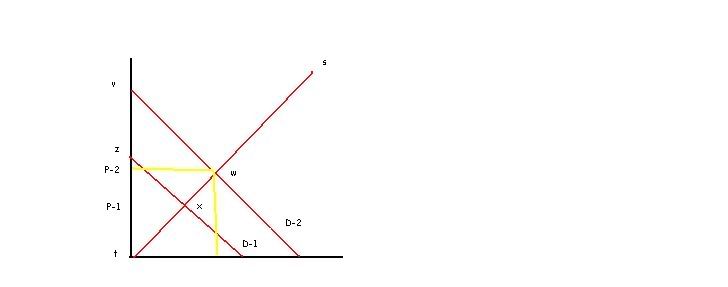

This diagram shows the effect of an increase in demand for cherry tomatoes. this will cause:

A) produxcer surplus and consumer surplus to increase

B) consumer surplus and producer surplus to decrease

C) producer surplus to decrease and consumer surplus to remain unchanged

D) no change in either consumer or producer surplus.

i really cant work this one out, surely the producer surplus increases and consumer decreases?

please help me thank you so much

Quick Reply

Related discussions

- TSR Study Together - STEM vs Humanities!

- Edexcel A Level Economics A Paper 1 (9ECO 01) - 15th May 2024 [Exam Chat]

- A-level Economics Study Group 2023-2024

- Economics Application

- Edinburgh or Bath for Economics?

- Eduqas A level Economics

- 2023 WJEC Ecomnomics A Level Grade Boundaries

- is 'taxi driver' classed as a job of a lower socio-economic background?

- Aqa Economics or Edexcel Politics or Aqa Sociology???

- A-level Economics Study Group 2022-2023

- alevel economics

- Official University of Roehampton Applicant Thread for 2024

- economics a level aqa

- Geography vs Economics A level choices

- Help me pick unis

- Economics at Aberdeen

- LSE Economics: without FurtherMaths

- GCSEs good enough for Econ and Econ history?

- Choosing Between Reading and Loughborough for Economics & Investment Banking

- IGCSE forum?

Latest

Last reply 1 minute ago

Official University of the Arts London Applicant Thread for 2024Last reply 4 minutes ago

WJEC Eduqas English Literature prediction 2024Last reply 10 minutes ago

Official: University of Aberdeen A100 2024 Entry ApplicantsLast reply 11 minutes ago

Latest time to apply for the means tested part of the maintance loanLast reply 13 minutes ago

LSE Economic history departmentLast reply 13 minutes ago

Amazon Project management apprenticeship 2024Last reply 14 minutes ago

Official UCL Offer Holders Thread for 2024 entryPosted 21 minutes ago

Best SEO Service Company In USA