Tax Cuts for the rich.

Scroll to see replies

Original post by billydisco

Still can't answer my points, guess which one of us is correct? Clue: the person justifying their views- me.

Original post by billydisco

Solve the issue? You/Labour created the issue!

Some people must be poor! Erradicating child poverty causes all this, by effectively guaranteeing any poor adult will be made wealthier by having kids.

Let them live in poverty- it will be short term pain for long term gain. It will send a message out to other people that they will not be bankrolled and you'll see such offspring numbers reduce.

Some people must be poor! Erradicating child poverty causes all this, by effectively guaranteeing any poor adult will be made wealthier by having kids.

Let them live in poverty- it will be short term pain for long term gain. It will send a message out to other people that they will not be bankrolled and you'll see such offspring numbers reduce.

"Let them live in poverty" We're supposed to be in the middle of economic recovery and you're saying people should except standards to not get better and also not complain about it? Ridiculous, also the tax break is hysterical, Osbourne would never stick to his porky filled manifesto on spending and relieving austerity anyway but now they're giving a break for top earners? Typical Tories

Posted from TSR Mobile

Billydisco is 100% right with everything he said, the majority of people in poverty will remain poor and that's how it is and will be for ever, some will succeed due to the fact that they aren't dumb and the good education their parents give them. Being human is being realist, let's be realist for a second , will you ever think that a child from a very young couple living in an estate in London that is only interested in buying shoes from Jd or anything else that our society offers to buy will succeed in their life? Well yeah maybe a very small chance if his parents are actually very mature and will be able to give a good education but is this likely to happen today? The child will follow his parents path which is poverty, these people might think they are rich by buying £90 shoes at JD, I've seen people like this, even you did, this is just reality of

things, the majority of poor people will stay poor apart if they get a good education that's it.

Posted from TSR Mobile

things, the majority of poor people will stay poor apart if they get a good education that's it.

Posted from TSR Mobile

Original post by illegaltobepoor

http://citywire.co.uk/money/osborne-weighs-tory-calls-for-higher-rate-tax-cut/a822755

George Osborne is thinking of cutting the top rate of income tax from 45% to 40%.

So for all my banker types out there it looks like Christmas has came early.

George Osborne is thinking of cutting the top rate of income tax from 45% to 40%.

So for all my banker types out there it looks like Christmas has came early.

Wonderful news.

Original post by Jammy Duel

Exactly...

The top have had a small cut, the bottom has had a large cut, the middle has had a moderate cut. But of course the moaners will do nothing but focus on that small cut at the top rather than looking at the bigger picture that is a bit cut and the bottom and an increase in the percentage of the tax being paid coming from the top. They have a nominal tax cut, a relative tax increase.

The top have had a small cut, the bottom has had a large cut, the middle has had a moderate cut. But of course the moaners will do nothing but focus on that small cut at the top rather than looking at the bigger picture that is a bit cut and the bottom and an increase in the percentage of the tax being paid coming from the top. They have a nominal tax cut, a relative tax increase.

The debate is how best to raise revenue, the 50% tax would have raised more revenue if it was permenant. George Osbournes plan A failed and tax revenues did not go up enough and borrowing did not come down quick enough, so they have been forced to CUT even more from welfare.

There is a very basic economic concept called ' marginal propensity to consume '. Essentially if you take money away from students and poor people then demand in the economy falls and this effects middle class people who own the places where poor people spend and Rich people who get profits from the sucess of the middle class.

The economy is a mess, tax cuts for rich combined with asset bubbles from QE2 have been a disaster.

The primary purpose of economic policy is to boost aggregate demand in the economy, cutting taxes for people earning over £150,000 does not help achieve that goal. No rich person will stop investing because the return on their investment is 5% less.

Original post by SotonianOne

Urgh

http://www.france24.com/en/20140914-france-super-rich-fortunes-belgium

20+ billionaires have left France, taking a total of 17 billion in capital/cash with them. Probably not a product of the tax rate, it's just a coincidence they all moved between 2013-2015 in a sudden spike of emigration interest.

Who cares that two of the richest 3 French citizens are no longer French, but Belgian? Who cares that France lost 12 billion in revenue and had to make cuts to the disability allowances? It's all moral, at the end of the day. Hit the rich with taxes and get hit back, that's the way we do it in Bornbluelandia.

As long as the dirty, filthy rich are no longer resident in my utopia, I am satisfied, even if all of my citizens live in huts. Equality for all.

No.

http://www.france24.com/en/20140914-france-super-rich-fortunes-belgium

20+ billionaires have left France, taking a total of 17 billion in capital/cash with them. Probably not a product of the tax rate, it's just a coincidence they all moved between 2013-2015 in a sudden spike of emigration interest.

Who cares that two of the richest 3 French citizens are no longer French, but Belgian? Who cares that France lost 12 billion in revenue and had to make cuts to the disability allowances? It's all moral, at the end of the day. Hit the rich with taxes and get hit back, that's the way we do it in Bornbluelandia.

As long as the dirty, filthy rich are no longer resident in my utopia, I am satisfied, even if all of my citizens live in huts. Equality for all.

No.

Belgium has higher taxes on individual then the UK.

Do tell me, when we raised tax to 50%, how many flocked to Belgium?

Pure scaremongering and you know it.

Force the rich people to pay their tax, make tax avoidance illegal and claim back every penny of tax owed.

Because we absolutely should not bow down to their threats because soon you'll start saying if we don't reduce the rate to 20%.

They won't all leave. It's a fallacy.

The capitalist plays his trump card- and fails

Spectacularly. You're economics are so absent of any logic. You're incredibly greed but somehow convince yourself it works out for the best of everyone.

You can stick your manipulated graphs up your arse mate, the rest of your ideas seem to come from there.

(edited 8 years ago)

[QUOTE="SotonianOne;57365449"]

Once again: Since the tax rate was cut from 50% to 45%, the UK Treasury has received more money from the top rate threshold payers than in the years before. Tax rate was DECREASED but tax revenue INCREASED.

This is called a Laffer curve and is GCSE Economics.

But I know this is of no interest to dirty Labourites, as all they want to do is bring people down to their level.

* Firstly, you've just committed the fallacy of post hoc ergo propter hoc. Just because an increase in tax revenues from the rich followed the tax cut, it does not mean that the tax cut caused the increase in tax revenues.

* You talk about the Laffer curve, yet you fail to mention that most studies have found that the optimal tax rate is about 70%.

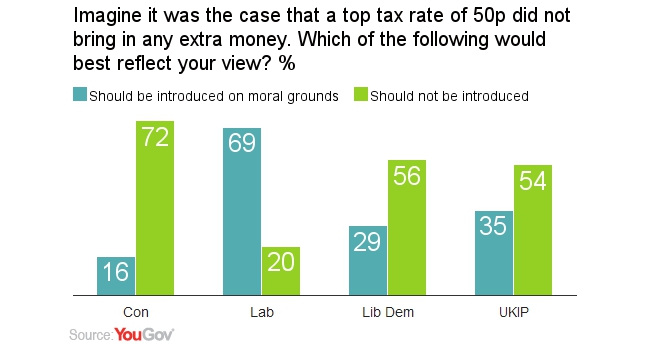

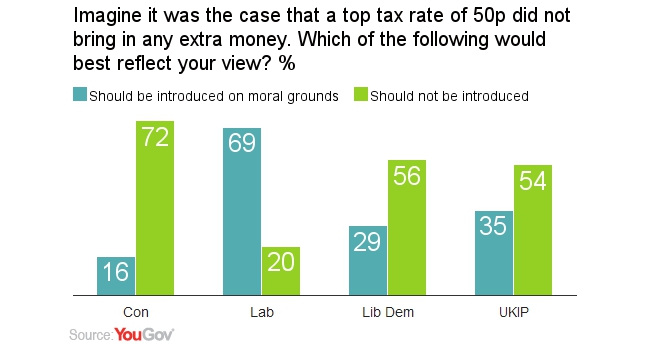

* You cite a poll which, in the question, makes the assumption that the 50p tax rate would not raise more money, and yet you fail to mention the fact that, according to the Institute for Fiscal Studies: "HMRC estimates that the 50% tax rate resulted in substantial income ‘forestalling’ – the bringing forward of income from 2010–11 to 2009–10 in an effort to avoid the higher marginal rate of tax in 2010–11. This forestalling would have raised top incomes in 2009–10 and depressed top incomes in 2010–11." In other words, if the 50p tax rate had been maintained for a longer period of time, it would probably have raised more revenue. And, without the assumption in the question, there is broad support for increasing income tax on the rich.

* Even if we assume, for a moment, that the tax cut did cause there to be a long-term increase in revenues, using the Laffer curve, we'll eventually have to stop cutting taxes for the rich.

(And, your economics doesn't improve the general well-being of the country; your style of economics is a religion which has been repeatedly disproved, and which has repeatedly caused recessions and depressions, most recently the recession caused by the financial crisis).

It is true that we need to tighten up rules on tax avoidance so that the rich cannot avoid paying income tax when it is increased, though. It's good to see that global leaders, apart from David Cameron, of course, are generally supporting this. We should also consider other taxes which would be impossible, or virtually impossible, to avoid, and which would raise a lot of revenue from the top 1%. These include the Land Value Tax and the EU-wide financial transactions tax.

Once again: Since the tax rate was cut from 50% to 45%, the UK Treasury has received more money from the top rate threshold payers than in the years before. Tax rate was DECREASED but tax revenue INCREASED.

This is called a Laffer curve and is GCSE Economics.

But I know this is of no interest to dirty Labourites, as all they want to do is bring people down to their level.

* Firstly, you've just committed the fallacy of post hoc ergo propter hoc. Just because an increase in tax revenues from the rich followed the tax cut, it does not mean that the tax cut caused the increase in tax revenues.

* You talk about the Laffer curve, yet you fail to mention that most studies have found that the optimal tax rate is about 70%.

* You cite a poll which, in the question, makes the assumption that the 50p tax rate would not raise more money, and yet you fail to mention the fact that, according to the Institute for Fiscal Studies: "HMRC estimates that the 50% tax rate resulted in substantial income ‘forestalling’ – the bringing forward of income from 2010–11 to 2009–10 in an effort to avoid the higher marginal rate of tax in 2010–11. This forestalling would have raised top incomes in 2009–10 and depressed top incomes in 2010–11." In other words, if the 50p tax rate had been maintained for a longer period of time, it would probably have raised more revenue. And, without the assumption in the question, there is broad support for increasing income tax on the rich.

* Even if we assume, for a moment, that the tax cut did cause there to be a long-term increase in revenues, using the Laffer curve, we'll eventually have to stop cutting taxes for the rich.

(And, your economics doesn't improve the general well-being of the country; your style of economics is a religion which has been repeatedly disproved, and which has repeatedly caused recessions and depressions, most recently the recession caused by the financial crisis).

It is true that we need to tighten up rules on tax avoidance so that the rich cannot avoid paying income tax when it is increased, though. It's good to see that global leaders, apart from David Cameron, of course, are generally supporting this. We should also consider other taxes which would be impossible, or virtually impossible, to avoid, and which would raise a lot of revenue from the top 1%. These include the Land Value Tax and the EU-wide financial transactions tax.

(edited 8 years ago)

Original post by billydisco

Who all received a free education?

Billy,

If you're going to quote a number of my posts then do it in one post rather than four to avoid clogging the thread and it helps to keep up with what's happening.

As to the above point, you seem quite a believer in the American Dream which referred to becoming president but had been extended to being 'rich'.

The initial idea that anyone, from any background can become president if they work hard enough,.

That there are no barriers to success and that the state should stay out of peoples way.

Yet this coming 2016 Presidential election is likely going to be fought by Bush v Clinton. Clinton seems the likely winner, the presidency, apart from Obama will have gone back and forth between two families for the last 30-40 years.

But equality of opportunity yeah?

Almost every president and major party candidate comes from a hugely wealthy background. But we kid ourselves that we all have the same opportunity.

Yes we all have free education up to the age of 18. But that one fact does not even paper over the cracks over the huge inequality of the system.

Whilst those from more privileged families can afford to send their children to top class private schools, those from poorer families simply can't.

You may go ' yeah but they have free education'. Yes, I was lucky in that I went to a religious state school which was a very high standard, but many state schools simply are not a high standard and that's not the fault of the children.

You advocate lower taxes, so there is less money for the schools, not to mention the right wing new labour turning many of them into free schools.

Many of the poorer children are left with the only option of going to a badly, underfunded state school.

You also want lower taxes which if implemented further reduces the standards.

So that leaves a position where the richer kids can go to a top class private school and many of the poorer kids left in an underfunded, crumbling state school.

Now I won't say rich people don't work hard, many do. But the issue is that they are working hard from a very high base that was given to them. Poor people must work that much harder as their base is far lower. We have a system where those at the top can work averagely hard and still succeed and have enough money to get by whereas those at the bottom must work exceptionally hard.

You also mention libraries? Good point, they could help those at the bottom. But wait a second, didn't the tories close them down...

We have a system where the wealthier kids already start 5 or 6 rungs higher up the ladder and you wax lyrical going on about how we have equality of opportunity because the poor are merely on the ladder, albeit on the first rung.

If this was a 100 metre race, the rich folk start the race at 50 metres whilst the poor start 5 metres behind the starting line with a boulder tied to their leg and you go ' look everyone can succeed if they try hard enough'.

I don't have a problem with private schools per se, but then we must invest heavily in state schools so the kids there have a chance to compete. To start them off a few rungs higher up the ladder.

But every time those at the bottom are offered support you go mad. Despite what you think, child benefits and child care massively helped increase social mobility under New Labour, and i'm no New Labour fan. They meant that mothers could go out to work and earn money and also have their children looked after, they were a key driver of social mobility, yet you want to get rid of that because a few people abuse it?

Which brings us back to the American Dream, bury your head in the sand and pretend that because we all have a free education that we all have the same chance, that there are no social barriers to success and that anyone who doesn't make it is lazy.

We don't have equality of opportunity, we never will but that doesn't mean we shouldn't strive for a more equal society.

But you hold huge prejudices against those from poorer backgrounds, you seem to have a victim complex and are just looking for someone to blame.

Original post by ChaoticButterfly

Well if that were the case I'd tick the green box. But I'm not convinced.There is however other aspects to consider, like the mental well being that different levels of equality creates in it citizens.

Imagine if cutting welfare and public services increased debt. Should it be introduced on moral grounds (talking thatcher morals here)? Or should it not be introduced?

Imagine if cutting welfare and public services increased debt. Should it be introduced on moral grounds (talking thatcher morals here)? Or should it not be introduced?

Cutting welfare and public services diesnt increase debt.

Original post by MatureStudent36

Cutting welfare and public services diesnt increase debt.

Yes it can.

But it was a thought experiment anyway so you are missing the point.

Original post by ChaoticButterfly

Yes it can.

But it was a thought experiment anyway so you are missing the point.

But it was a thought experiment anyway so you are missing the point.

Here's a hint. If you're having. A thought experiment, look at what really happens.

I can't think that water flows up hill because gravity doesn't exist, because gravity does exist.

Original post by Bornblue

Belgium has higher taxes on individual then the UK.

Do tell me, when we raised tax to 50%, how many flocked to Belgium?

Pure scaremongering and you know it.

Force the rich people to pay their tax, make tax avoidance illegal and claim back every penny of tax owed.

Because we absolutely should not bow down to their threats because soon you'll start saying if we don't reduce the rate to 20%.

They won't all leave. It's a fallacy.

The capitalist plays his trump card- and fails

Spectacularly. You're economics are so absent of any logic. You're incredibly greed but somehow convince yourself it works out for the best of everyone.

You can stick your manipulated graphs up your arse mate, the rest of your ideas seem to come from there.

Do tell me, when we raised tax to 50%, how many flocked to Belgium?

Pure scaremongering and you know it.

Force the rich people to pay their tax, make tax avoidance illegal and claim back every penny of tax owed.

Because we absolutely should not bow down to their threats because soon you'll start saying if we don't reduce the rate to 20%.

They won't all leave. It's a fallacy.

The capitalist plays his trump card- and fails

Spectacularly. You're economics are so absent of any logic. You're incredibly greed but somehow convince yourself it works out for the best of everyone.

You can stick your manipulated graphs up your arse mate, the rest of your ideas seem to come from there.

lol it is common knowledge no one pays the top rate of tax in belgium. the same for corporation tax and inheritance tax

Original post by viddy9

* Firstly, you've just committed the fallacy of post hoc ergo propter hoc. Just because an increase in tax revenues from the rich followed the tax cut, it does not mean that the tax cut caused the increase in tax revenues.

Obviously. Let's ignore the fact that this has been the situation in the UK, Russia and the opposite in France. It must be a coincidence that tax revenues change with immediate effect,

Original post by viddy9

* You talk about the Laffer curve, yet you fail to mention that most studies have found that the optimal tax rate is about 70%.

Not sure how the quantity of something is more important than the quality or reality. Obviously this has never been a case in a 70% tax rate country and one of the two of the most important factors are vulnerability to tax avoidance/evasion in legislation as well as external factors including competition with foreign tax rates. The Rich aren't static.

Original post by viddy9

* You cite a poll which, in the question, makes the assumption that the 50p tax rate would not raise more money, and yet you fail to mention the fact that, according to the Institute for Fiscal Studies:

What is the point of this point? It was a survey question to find out whether people belonging to different parties would issue a higher tax rate purely for moral grounds. There is no need for statistics. What it has revealed is that Labourites are dirty envious filthy people.

Original post by viddy9

"HMRC estimates that the 50% tax rate resulted in substantial income ‘forestalling’ – the bringing forward of income from 2010–11 to 2009–10 in an effort to avoid the higher marginal rate of tax in 2010–11. This forestalling would have raised top incomes in 2009–10 and depressed top incomes in 2010–11."

Do you have a link for this?

Original post by viddy9

In other words, if the 50p tax rate had been maintained for a longer period of time, it would probably have raised more revenue. And, without the assumption in the question, there is broad support for increasing income tax on the rich.

Due to inflation/economic growth or due to actual real growth in tax revenue?

Original post by viddy9

* Even if we assume, for a moment, that the tax cut did cause there to be a long-term increase in revenues, using the Laffer curve, we'll eventually have to stop cutting taxes for the rich.

No, we need to find the optimum point for that decade and stick to it.

Original post by viddy9

(And, your economics doesn't improve the general well-being of the country; your style of economics is a religion which has been repeatedly disproved, and which has repeatedly caused recessions and depressions, most recently the recession caused by the financial crisis).

Yeah right.

Original post by viddy9

It is true that we need to tighten up rules on tax avoidance so that the rich cannot avoid paying income tax when it is increased, though. It's good to see that global leaders, apart from David Cameron, of course, are generally supporting this. We should also consider other taxes which would be impossible, or virtually impossible, to avoid, and which would raise a lot of revenue from the top 1%. These include the Land Value Tax and the EU-wide financial transactions tax.

No one in the EU leadership supports a LVT, so not sure why you feel a particular urge to point DC out.

Original post by SotonianOne

lol it is common knowledge no one pays the top rate of tax in belgium. the same for corporation tax and inheritance tax

The foundation of your entire argument is that rich people will flee if we make them pay their tax and a wage that their workers can live on.

The capitalist trump card.

It's a nonsense argument, completely unproven but I think the danger is you actually start to believe it.

Our entire economic system should not be based on the selfishness of those at the top.

When we upped the top rate of tax to 50% how many people fled the country?

A crackdown on tax avoidance would massively solve the problem.

Our economic system should not be based on a few guys at the top wanting to pay a bit less tax and then using their own selfishness as a justification for lowering their taxes.

And you crticise Labour despite them being very much a thatcherite, neo-liberal, free market party who have offered no alternative to the economic system.

The Overton window effect once again.

Original post by Bornblue

The foundation of your entire argument is that rich people will flee if we make them pay their tax and a wage that their workers can live on.

The capitalist trump card.

It's a nonsense argument, completely unproven but I think the danger is you actually start to believe it.

Our entire economic system should not be based on the selfishness of those at the top.

When we upped the top rate of tax to 50% how many people fled the country?

A crackdown on tax avoidance would massively solve the problem.

Our economic system should not be based on a few guys at the top wanting to pay a bit less tax and then using their own selfishness as a justification for lowering their taxes.

And you crticise Labour despite them being very much a thatcherite, neo-liberal, free market party who have offered no alternative to the economic system.

The Overton window effect once again.

The capitalist trump card.

It's a nonsense argument, completely unproven but I think the danger is you actually start to believe it.

Our entire economic system should not be based on the selfishness of those at the top.

When we upped the top rate of tax to 50% how many people fled the country?

A crackdown on tax avoidance would massively solve the problem.

Our economic system should not be based on a few guys at the top wanting to pay a bit less tax and then using their own selfishness as a justification for lowering their taxes.

And you crticise Labour despite them being very much a thatcherite, neo-liberal, free market party who have offered no alternative to the economic system.

The Overton window effect once again.

sugar to florida and branson to jersey, for one.

there is no such statistics that are made/available

anyways, this conversation is pointless

Original post by SotonianOne

sugar to florida and branson to jersey, for one.

there is no such statistics that are made/available

anyways, this conversation is pointless

there is no such statistics that are made/available

anyways, this conversation is pointless

Nonsense argument. Prove they went for the tax rate.

The thing that amuses me most about this debate- vis a vis whether rich people would leave the country -is that ,personally ,I'd be all for high rates of income tax providing many rich people do indeed ****** off!

That's by far the best way to have a more equal society.

Anything else is just playing at this equality lark.

That's by far the best way to have a more equal society.

Anything else is just playing at this equality lark.

(edited 8 years ago)

Not sure if this particular article has been brought in yet but I read this quite recently:

http://blogs.spectator.co.uk/coffeehouse/2013/03/celebrating-the-25th-anniversary-of-nigel-lawsons-tax-cutting-budget/

It is proven that cutting taxes on the rich will increase revenues levied from the top earners. This either arises through them no longer engaging in measures of tax evasion and/or avoidance, or bringing in wealthy foreign investors from abroad.

These revenues can thus be used to further invest in public services or simply reduce a deficit and eventually pay off national debt.

Burdening the rich in such a manner may be seen as 'morally' right by those who strive for pretty much absolute income equality, but economically and fiscally it makes no sense. The more recent cut from 50% to 45% (which is still higher than it was under Labour before Brown raised it prior to the 2010 election so the Tories would have to cut it and thus make them look like 'the party for the rich' etc.) has also increased taxes paid by the rich in the same manner as can be seen here:

http://blogs.telegraph.co.uk/news/tobyyoung/100285630/why-the-leader-of-the-tuc-should-vote-conservative/

As for the rich leaving when taxes are raised; is that not exactly what happened in France when the tax rate for top earners became 75%?

http://blogs.spectator.co.uk/coffeehouse/2013/03/celebrating-the-25th-anniversary-of-nigel-lawsons-tax-cutting-budget/

It is proven that cutting taxes on the rich will increase revenues levied from the top earners. This either arises through them no longer engaging in measures of tax evasion and/or avoidance, or bringing in wealthy foreign investors from abroad.

These revenues can thus be used to further invest in public services or simply reduce a deficit and eventually pay off national debt.

Burdening the rich in such a manner may be seen as 'morally' right by those who strive for pretty much absolute income equality, but economically and fiscally it makes no sense. The more recent cut from 50% to 45% (which is still higher than it was under Labour before Brown raised it prior to the 2010 election so the Tories would have to cut it and thus make them look like 'the party for the rich' etc.) has also increased taxes paid by the rich in the same manner as can be seen here:

http://blogs.telegraph.co.uk/news/tobyyoung/100285630/why-the-leader-of-the-tuc-should-vote-conservative/

As for the rich leaving when taxes are raised; is that not exactly what happened in France when the tax rate for top earners became 75%?

Original post by ZedsDead

Not sure if this particular article has been brought in yet but I read this quite recently:

http://blogs.spectator.co.uk/coffeehouse/2013/03/celebrating-the-25th-anniversary-of-nigel-lawsons-tax-cutting-budget/

It is proven that cutting taxes on the rich will increase revenues levied from the top earners. This either arises through them no longer engaging in measures of tax evasion and/or avoidance, or bringing in wealthy foreign investors from abroad.

These revenues can thus be used to further invest in public services or simply reduce a deficit and eventually pay off national debt.

Burdening the rich in such a manner may be seen as 'morally' right by those who strive for pretty much absolute income equality, but economically and fiscally it makes no sense. The more recent cut from 50% to 45% (which is still higher than it was under Labour before Brown raised it prior to the 2010 election so the Tories would have to cut it and thus make them look like 'the party for the rich' etc.) has also increased taxes paid by the rich in the same manner as can be seen here:

http://blogs.telegraph.co.uk/news/tobyyoung/100285630/why-the-leader-of-the-tuc-should-vote-conservative/

As for the rich leaving when taxes are raised; is that not exactly what happened in France when the tax rate for top earners became 75%?

http://blogs.spectator.co.uk/coffeehouse/2013/03/celebrating-the-25th-anniversary-of-nigel-lawsons-tax-cutting-budget/

It is proven that cutting taxes on the rich will increase revenues levied from the top earners. This either arises through them no longer engaging in measures of tax evasion and/or avoidance, or bringing in wealthy foreign investors from abroad.

These revenues can thus be used to further invest in public services or simply reduce a deficit and eventually pay off national debt.

Burdening the rich in such a manner may be seen as 'morally' right by those who strive for pretty much absolute income equality, but economically and fiscally it makes no sense. The more recent cut from 50% to 45% (which is still higher than it was under Labour before Brown raised it prior to the 2010 election so the Tories would have to cut it and thus make them look like 'the party for the rich' etc.) has also increased taxes paid by the rich in the same manner as can be seen here:

http://blogs.telegraph.co.uk/news/tobyyoung/100285630/why-the-leader-of-the-tuc-should-vote-conservative/

As for the rich leaving when taxes are raised; is that not exactly what happened in France when the tax rate for top earners became 75%?

It's a nonsense argument. The foundation being the selfishness and threats of those at the top.

It's no surprise that those at the top tell us that taxing them less works out for everyone.

And if the rich people want to cry, spit their dummies out, threaten us and leave well then frankly I'll volunteer to drop them off at the airport.

I don't believe that they are the wealth creators and I don't believe in the mythical trickle down effect. I'm certainly not going to let those at the top spitting out their Dummies be a deterrent.

(edited 8 years ago)

Original post by Bornblue

It's a nonsense argument. The foundation being the selfishness and threats of those at the top.

It's no surprise that those at the top tell us that taxing them less works out for everyone.

And if the rich people want to cry, spit their dummies out, threaten us and leave well then frankly I'll volunteer to drop them off at the airport.

I don't believe that they are the wealth creators and I don't believe in the mythical trickle down effect. I'm certainly not going to let those at the top spitting out their Dummies be a deterrent.

It's no surprise that those at the top tell us that taxing them less works out for everyone.

And if the rich people want to cry, spit their dummies out, threaten us and leave well then frankly I'll volunteer to drop them off at the airport.

I don't believe that they are the wealth creators and I don't believe in the mythical trickle down effect. I'm certainly not going to let those at the top spitting out their Dummies be a deterrent.

Fair point but if they leave then who's going to fill the gap left by the lost tax revenues? Raise taxes on the middle income and poor? Cut public spending?

Quick Reply

Related discussions

- 2024 Budget: Chancellor Jeremy Hunt under pressure to cut taxes

- Labour plans to add 20% VAT to Private School fees.

- The Rot Of The Lottery

- Edexcel A Level Economics A Paper 3 (9ECO 03) - 5th June 2023 [Exam Chat]

- Have the Tories stopped being Conservative?

- If you think you will be rich as a dentist you're mistaken (I'm an associate Dentist)

- [Official Thread] Chancellor Jeremy Hunt to deliver Autumn Statement on Wednesday

- UK Medical School Debt is about £184.5k over 30 years

- Explain Liss truss policies to me

- Was my employer over taxing me?? Please help

- Wtf is going on with my taxes? Am i being overtaxed at my employer?

- Types of Law practitioners in the UK.

- Paychecks at work

- 16 million miles of England’s bus routes axed

- Pay from work

- Jeremy Hunt to deliver budget on March 6 as election looms

- Australia &Uk

- Any predictions for 2024?

- Is earning 25k a year considered poor?

- Shrouded In Shame

Latest

Last reply 2 minutes ago

Official London School of Economics and Political Science 2024 Applicant ThreadLast reply 2 minutes ago

What games did everybody play on their computers at school or when they were youngerGaming

11

Last reply 38 minutes ago

Official University of St Andrews Applicant Thread for 2024Last reply 46 minutes ago

Official Veterinary Medicine Applicants thread 2024 entryLast reply 56 minutes ago

BAE systems degree apprenticeships September 2024Last reply 1 hour ago

What is the difference between ejusdem generis and noscitur a sociis?Trending

Last reply 3 hours ago

Even Europe’s far-right firebrands seem to sense Brexit is a disaster- The GuardianLast reply 11 hours ago

Why is the political left now censorious and authoritarian??Last reply 2 days ago

Sunak rejects offer of youth mobility scheme between EU and UKLast reply 1 week ago

Rayner denies wrongdoing over council house sale amid police reviewLast reply 1 week ago

TSR Goes Green: How important will the environment be in this year's election?Last reply 2 weeks ago

TSR Big Discussion #1: What should be top priority to protect the environment?Last reply 2 weeks ago

Where do you stand on the political spectrum (8values)? – Take a quiz here!Last reply 3 weeks ago

2024 UK general election speculation and build-up threadLast reply 3 weeks ago

No progress made on half of UK government’s levelling-up targetsLast reply 3 weeks ago

Trump needs a $464m bond in six days. What if he can't get it?Trending

Last reply 3 hours ago

Even Europe’s far-right firebrands seem to sense Brexit is a disaster- The GuardianLast reply 11 hours ago

Why is the political left now censorious and authoritarian??Last reply 2 days ago

Sunak rejects offer of youth mobility scheme between EU and UKLast reply 1 week ago

Rayner denies wrongdoing over council house sale amid police reviewLast reply 1 week ago

TSR Goes Green: How important will the environment be in this year's election?Last reply 2 weeks ago

TSR Big Discussion #1: What should be top priority to protect the environment?Last reply 2 weeks ago

Where do you stand on the political spectrum (8values)? – Take a quiz here!Last reply 3 weeks ago

2024 UK general election speculation and build-up threadLast reply 3 weeks ago

No progress made on half of UK government’s levelling-up targetsLast reply 3 weeks ago

Trump needs a $464m bond in six days. What if he can't get it?