Reue's Pension FAQ

Scroll to see replies

Original post by ByEeek

Thirty years ago, the second person's income didn't count so house prices were reflected in that accordingly.

Are you sure? You might not have got x3 on the second income but I'm pretty sure it counted.

Posted from TSR Mobile

Original post by Doonesbury

Are you sure? You might not have got x3 on the second income but I'm pretty sure it counted.

Posted from TSR Mobile

Posted from TSR Mobile

I'm sure about this back in the 70s, but it was only in the late 80s / early 90s that the mortgage market was deregulated. What I do know is that my parents stretched themselves in 1988 by purchasing a £56k house. My dad was on around £19k but it was the repressive interest rates that were against them at the time.

By contrast, my wife and I comfortably afforded our £230k house together. Ironically, we now have a joint income of less than £45k but low interest rates are making things very affordable. Should be ok though as we are fixed for 5 years.

Original post by ByEeek

My dad was on around £19k but it was the repressive interest rates that were against them at the time.

Yes my mortgage got to 15%, and negative equity, in the v. early 90s.

Managed to survive and then get a series of reasonable fixed rates.

Original post by Doonesbury

Are you sure? You might not have got x3 on the second income but I'm pretty sure it counted.

Posted from TSR Mobile

Posted from TSR Mobile

I don't know in the Uk. On this side of the pond, i knew 3 young couples that were trying to qualify for a house. In each case, the woman had some minor job doing day care, part time teaching, or such. Typically, the woman made about $20,000 a year, working less than 40 hrs a week. Two of the couples involved guys that were engineers [that, in part, was how i knew them]. They were junior to me, consequently they made less - say about $45,000 to $50,000 a year for the guys. The two couples involving engineers, both had their eyes on a particular house, but they just missed being able to qualify for a loan on it. After they passed the law requiring the woman's income to be considered, both couples re-applied for a loan. They both again just failed to qualify, because the asking price of the houses had gone up an amount nearly equal to the gross income of the woman in the couple.

One of them figured "to heck with it", and signed up for an 'overseas tour' to make some money living overseas. As i recall, when they returned in 2 years or so, they had stashed enough dosh away to make a more substantial down payment, and qualified easily [this was about 1980]. I don't know what happened to the third couple, as they were not working for the government group i was with. I bought my house in 1971, so i got in before the 'woman's income' came into play. Cheers.

Original post by ByEeek

I'm sure about this back in the 70s, but it was only in the late 80s / early 90s that the mortgage market was deregulated. What I do know is that my parents stretched themselves in 1988 by purchasing a £56k house. My dad was on around £19k but it was the repressive interest rates that were against them at the time.

By contrast, my wife and I comfortably afforded our £230k house together. Ironically, we now have a joint income of less than £45k but low interest rates are making things very affordable. Should be ok though as we are fixed for 5 years.

By contrast, my wife and I comfortably afforded our £230k house together. Ironically, we now have a joint income of less than £45k but low interest rates are making things very affordable. Should be ok though as we are fixed for 5 years.

Using the 'double every 10 years' algorithm, your dad's salary would be about 80k quid in today's money [two full doubles, and then 2008 to 2016]. His house would be worth slightly more than your 230k quid house. This is assuming that the 'double every 10 holds on your side of the pond. There must be an inflation computing algorithm on the web somewhere to do this more exactly.

The insidious thing is that for many people, salary increases have not been keeping up with inflation. Highly technical positions have kept up [design engineers, software developers, and physicians/solicitors]. In many other areas, people have been falling behind. It used to be that people got started by building or re-furbishing their first house. My technical mentor that got me into engineering, built his own house when he got out of the US Air Force in 1956. Unfortunately, of late, doing things involving manual labour [even for yourself] seems to have fallen out of favour. When i was at school - the only kids with cars, were those who could find one behind a farmer's barn, get it running themselves, and pay for it with their paper route money. Today, it's "daddy, daddy, buy me a new BMW!!" Not only do the kids have no interest in DIY or mechanics, neither do their 'rents. If you are independently wealthy, i guess this is ok. I've never lived that way though. Cheers.

Original post by Rabbit2

Using the 'double every 10 years' algorithm, your dad's salary would be about 80k quid in today's money [two full doubles, and then 2008 to 2016]. His house would be worth slightly more than your 230k quid house. This is assuming that the 'double every 10 holds on your side of the pond. There must be an inflation computing algorithm on the web somewhere to do this more exactly.

The insidious thing is that for many people, salary increases have not been keeping up with inflation. Highly technical positions have kept up [design engineers, software developers, and physicians/solicitors]. In many other areas, people have been falling behind. It used to be that people got started by building or re-furbishing their first house. My technical mentor that got me into engineering, built his own house when he got out of the US Air Force in 1956. Unfortunately, of late, doing things involving manual labour [even for yourself] seems to have fallen out of favour. When i was at school - the only kids with cars, were those who could find one behind a farmer's barn, get it running themselves, and pay for it with their paper route money. Today, it's "daddy, daddy, buy me a new BMW!!" Not only do the kids have no interest in DIY or mechanics, neither do their 'rents. If you are independently wealthy, i guess this is ok. I've never lived that way though. Cheers.

The insidious thing is that for many people, salary increases have not been keeping up with inflation. Highly technical positions have kept up [design engineers, software developers, and physicians/solicitors]. In many other areas, people have been falling behind. It used to be that people got started by building or re-furbishing their first house. My technical mentor that got me into engineering, built his own house when he got out of the US Air Force in 1956. Unfortunately, of late, doing things involving manual labour [even for yourself] seems to have fallen out of favour. When i was at school - the only kids with cars, were those who could find one behind a farmer's barn, get it running themselves, and pay for it with their paper route money. Today, it's "daddy, daddy, buy me a new BMW!!" Not only do the kids have no interest in DIY or mechanics, neither do their 'rents. If you are independently wealthy, i guess this is ok. I've never lived that way though. Cheers.

Agreed. Although in today's money his salary would have only been £35k to £40k based on the fact that he worked in the NHS.

And as for cars etc. They are vastly cheaper than they were in the 80s as a proportion of salary. In fact lots of stuff is. I remember buying my first sh1t tent in 1993 for £40. You can by the same tent now for a fiver. Good bless cheap imports.

Original post by ByEeek

Agreed. Although in today's money his salary would have only been £35k to £40k based on the fact that he worked in the NHS.

And as for cars etc. They are vastly cheaper than they were in the 80s as a proportion of salary. In fact lots of stuff is. I remember buying my first sh1t tent in 1993 for £40. You can by the same tent now for a fiver. Good bless cheap imports.

And as for cars etc. They are vastly cheaper than they were in the 80s as a proportion of salary. In fact lots of stuff is. I remember buying my first sh1t tent in 1993 for £40. You can by the same tent now for a fiver. Good bless cheap imports.

Your dad's salary is a function of the propensity of both our governments to rob us. Whilst inflation has doubled ever 10, salaries (at least since 1973 or so) have not kept up with that. That is why the ratio of house prices are no longer 3 to 3.5 average annual salary. Single family houses in my neighbourhood are running (asking price) about $300,000 to $350,000. This means that the 'average' income in the neighbourhood should be about $100,000 to $150,000. even if you lump the woman's income in, Say the guy makes $80,000 and she makes $30,000. The guy's income is comparable to a mid level electrical engineer, and hers is comparable to a mid level school teacher. I can assure you that the average employment in the neighbourhood, including salaries, is NOT that high. Probably just over half that would be more typical. This is why you see 10 or 15 latinos living in a single family house. Cheers.

Original post by Rabbit2

Your dad's salary is a function of the propensity of both our governments to rob us. Whilst inflation has doubled ever 10, salaries (at least since 1973 or so) have not kept up with that.

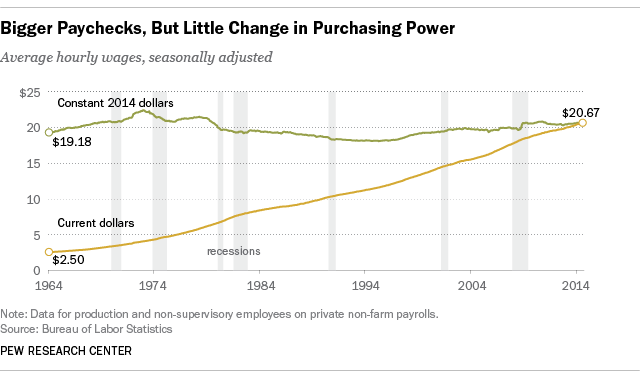

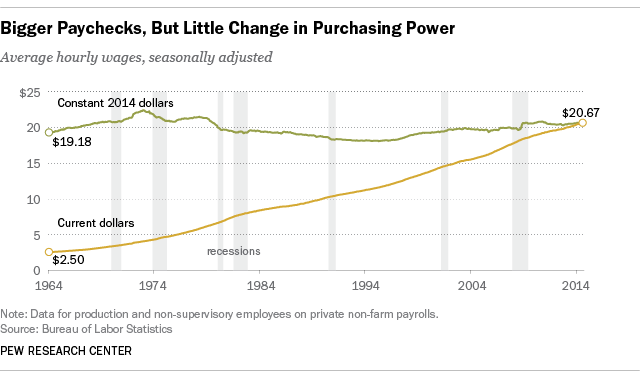

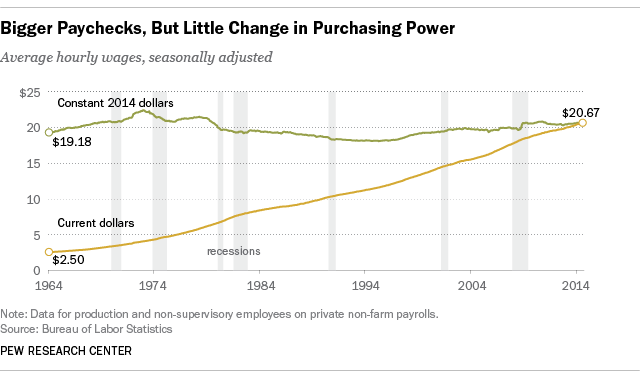

Nope, in the US average wages have pretty much kept pace with inflation.

Original post by Doonesbury

Nope, in the US average wages have pretty much kept pace with inflation.

Well, the "problem" is that the "inflation" numbers that everyone quotes are 'cooked' statistics. Actual inflation is much higher than what is quoted. They specifically exclude from 'inflation' statistics, food, fuel, and something else - i think real estate. These are the items rising the fastest. Cheers.

Original post by Rabbit2

Well, the "problem" is that the "inflation" numbers that everyone quotes are 'cooked' statistics. Actual inflation is much higher than what is quoted. They specifically exclude from 'inflation' statistics, food, fuel, and something else - i think real estate. These are the items rising the fastest. Cheers.

CPI - the usual measure of inflation - certainly does include food, fuel and housing costs.

https://www.investopedia.com/university/releases/cpi.asp

Original post by Rabbit2

Your dad's salary is a function of the propensity of both our governments to rob us. Whilst inflation has doubled ever 10, salaries (at least since 1973 or so) have not kept up with that. That is why the ratio of house prices are no longer 3 to 3.5 average annual salary. Single family houses in my neighbourhood are running (asking price) about $300,000 to $350,000. This means that the 'average' income in the neighbourhood should be about $100,000 to $150,000. even if you lump the woman's income in, Say the guy makes $80,000 and she makes $30,000. The guy's income is comparable to a mid level electrical engineer, and hers is comparable to a mid level school teacher. I can assure you that the average employment in the neighbourhood, including salaries, is NOT that high. Probably just over half that would be more typical. This is why you see 10 or 15 latinos living in a single family house. Cheers.

No, that's because interest rates are well down since 1973 when the FED rate was 11%.

Original post by Reue

It's bonkers. They're missing out on the company contribution and the tax relief. For example if you're a basic rate tax payer and on salary sacrifice; you pay around £70 to get £200 into your pension. What other investment is going to make that much instantly?!

I agree. When i was paying into my pension(s), [at each company i worked for], i always made sure i was putting in the maximum amount that i could under the current law. I then kept checking back with the HR people, to make sure that the maximum hadn't been raised. If it had (and it had a couple of times) i immediately raised my contribution to match the maximum. Practically nobody takes into account the "real" inflation rate [as opposed to the 'rigged' one that is quoted for political reasons]. When i started working as an engineer in 1969, i was buying 'pump petrol' at $0.20/ gallon(US). Now, it's $2.40/gallon. The publicised inflation figures exclude food, fuel, and housing - the three fastest rising items in most people's budget. This is so they can (falsely) claim that the "inflation rate is 'only' 5%. In reality, it's closer to 18% to 20%, when you include the 3 'omitted' items above. Realise that, when you retire, you will have to buy food, fuel, and housing at the 'going rate'. This means that your expenditures will be substantially more than most 'planners' and pension participants figure. I get just over $2000USD from Social Security, and about $800/month total, from 2 private pensions. I can manage to live in the D.C. area on this, but i do all my own work [car, house, computer, everything else]. I don't hire anything out, except for medical work [i'm not qualified to work in that area]. I drive a 1982 car which i fix myself. Many people can't operate this way, so (presumably) they would need more dosh to live here - if they were hiring out work. Cheers.

Original post by Rabbit2

When i started working as an engineer in 1969, ... I get just over $2000USD from Social Security, and about $800/month total, from 2 private pensions.

Actually if you have been a well paid engineer contributing the maximum monthly amount privately since 1969 I'm surprised your private pension is so much lower than Social Security.

And again regarding inflation - food fuel and housing ARE included.

https://www.thestudentroom.co.uk/showpost.php?p=76080784&postcount=92

(edited 6 years ago)

Original post by Doonesbury

Actually if you have been a well paid engineer contributing the maximum monthly amount privately since 1969 I'm surprised your private pension is so much lower than Social Security.

And again regarding inflation - food fuel and housing ARE included.

https://www.thestudentroom.co.uk/showpost.php?p=76080784&postcount=92

And again regarding inflation - food fuel and housing ARE included.

https://www.thestudentroom.co.uk/showpost.php?p=76080784&postcount=92

Part of the reason for the discrepancy is that Social Security is pro-rated over the 'average' lifespan. Eventually, your SS will run out of funds i understand. For my pensions, i selected the 'lifetime' option - so they will pay out as long as i live. Of course, it's 'defined benefit', so inflation will reduce the usefulness of each payment with time - but at least i won't run out of money. Right now, they just about pay my taxes on 2 houses. Cheers.

Original post by Rabbit2

Part of the reason for the discrepancy is that Social Security is pro-rated over the 'average' lifespan. Eventually, your SS will run out of funds i understand.

I've no idea if that is how it works in the US, but that's certainly not how it works in the UK. Your state pension will always rise, never decline (unless there was actual deflation in the overall economy, although even that is currently covered by a government promise to increase pensions by at least 2.5% no matter what).

Original post by Doonesbury

^this!!!!!!

(One small extra thing, I'd recommend having more than 1 pension provider - just in case...)

(One small extra thing, I'd recommend having more than 1 pension provider - just in case...)

Additionally, i would recommend NOT allowing your company to 'administer' your pension. Also, don't let anyone put stock from your company in your pension plan. If you want company stock, buy it from a regular broker. I did purchase TRW stock, when i worked for them. I got it at a nice discount, but was always leery of it. Shortly after i left them, they became the subject of a 'hostile takeover'. I withdrew my TRW stock and sold it. After that kind of a takeover, often the target company's stock tanks. It turned out, this time, that things went ok, and i could have kept it - without 'taking a bath'. I felt better, being out of their stock anyway. The problem with letting your company run things, is that in the past, often companies have 'packed' pension plans with company stock - which later turned out to be nearly worthless. The company went broke, and the workers ended up with nothing. Cheers.

Original post by Rabbit2

Additionally, i would recommend NOT allowing your company to 'administer' your pension. Also, don't let anyone put stock from your company in your pension plan. If you want company stock, buy it from a regular broker. I did purchase TRW stock, when i worked for them. I got it at a nice discount, but was always leery of it. Shortly after i left them, they became the subject of a 'hostile takeover'. I withdrew my TRW stock and sold it. After that kind of a takeover, often the target company's stock tanks. It turned out, this time, that things went ok, and i could have kept it - without 'taking a bath'. I felt better, being out of their stock anyway. The problem with letting your company run things, is that in the past, often companies have 'packed' pension plans with company stock - which later turned out to be nearly worthless. The company went broke, and the workers ended up with nothing. Cheers.

Pension administrators are usually completely independent of your employer company.

If you are employed by a listed company and you want to invest do it via an ISA (or the US equivalent - afaik that's an IRA). No capital gains or income tax is payable.

Original post by Rabbit2

Additionally, i would recommend NOT allowing your company to 'administer' your pension. Also, don't let anyone put stock from your company in your pension plan. If you want company stock, buy it from a regular broker. I did purchase TRW stock, when i worked for them. I got it at a nice discount, but was always leery of it. Shortly after i left them, they became the subject of a 'hostile takeover'. I withdrew my TRW stock and sold it. After that kind of a takeover, often the target company's stock tanks. It turned out, this time, that things went ok, and i could have kept it - without 'taking a bath'. I felt better, being out of their stock anyway. The problem with letting your company run things, is that in the past, often companies have 'packed' pension plans with company stock - which later turned out to be nearly worthless. The company went broke, and the workers ended up with nothing. Cheers.

Why shouldn't I let HMG administer my pension?

Original post by Rabbit2

When i started working as an engineer in 1969, i was buying 'pump petrol' at $0.20/ gallon(US). Now, it's $2.40/gallon. The publicised inflation figures exclude food, fuel, and housing - the three fastest rising items in most people's budget. This is so they can (falsely) claim that the "inflation rate is 'only' 5%. In reality, it's closer to 18% to 20%, .

according to this inflation calculator (thanks 2 seconds on google) that should be £3.22/gallon using official inflation figures based on January 1969.

http://www.hl.co.uk/tools/calculators/inflation-calculator

£3.09 if you meant December.

Original post by Quady

Why shouldn't I let HMG administer my pension?

HMG "administers" the state pension. Not personal or workplace pensions. Unless you mean NEST?

(edited 6 years ago)

Quick Reply

Related discussions

- Welcome to Money & Finance

- Student Finance Form for Parents doesn't make sense for pensions

- How much would tax and national insurance contribute and how much would I take away

- What is pension employee contribution

- RAF - What does it mean to be pensionable?

- Student Course loans repayments for a pensioner

- I am completing a pff2 form for my son

- Pension contributions -SFE

- “I’m 73 and in the retirement trap – my pension is too small but I can’t get a job”

- Marriage / divorce - pension

- Does the CS send postal letters?

- Current year assessment

- Tax Free Pension Lump sum

- Parental Income Assessment

- Are my pension calculations correct?

- Will my father on a government pension, private pension

- I Earn £466.94 each week how much will I earn each year

- Shock and awe- interest rates and pension reform; is there a different way?

- Sfe pension

- Northeastern University London Essay Competition (Shortlist)

Latest

Trending

Last reply 1 week ago

I think I have a Cifas Marker on my name , can I still open any banks ?Last reply 4 weeks ago

Has anyone had their student finance paid into their partners or parents bank?Last reply 1 month ago

Introduction to UK Financial regulations and professional integrity SCAMTrending

Last reply 1 week ago

I think I have a Cifas Marker on my name , can I still open any banks ?Last reply 4 weeks ago

Has anyone had their student finance paid into their partners or parents bank?Last reply 1 month ago

Introduction to UK Financial regulations and professional integrity SCAM