How much must you earn to be considered as "rich"?

Scroll to see replies

Original post by CheetahCurtis

If you aren't left with anything while earning 200k a year you should probably stop eating caviar...

I would have thought if you were earning 50k you would be pretty well off!

I would have thought if you were earning 50k you would be pretty well off!

I tell you from experience - you are wrong.

Original post by TitanicTeutonicPhil

I tell you from experience - you are wrong.

You pretty much need to be earning at least 1 Mill per year to be almost well off in my opinion.

Basically, only 18,000 people in the UK are well off, out of the 64,000,000 people who dwell there (1 in 5000).

Original post by Doctor_Einstein

I consider being in the top 5% of all human beings in the world as being rich, and thus you are rich if you earn more than 20k per year. If you earn 200k, you are in the top 0.1% in the world by income.

Exactly.

Original post by poohat

A 2 child family in London with a stay-at-home mother and a father who works a minimum wage job has the equivalent of a £40k gross salary after government benefits. So £50k for a family is barely more than minimum wage

You certainly cant raise a family in London on £50k (I know people are going to say "but my parents earned less than that and we were fine" - see the above post).

You certainly cant raise a family in London on £50k (I know people are going to say "but my parents earned less than that and we were fine" - see the above post).

Most people in the UK (85%) don't live in London.

True story.

Original post by Princepieman

Considering my dad was on ~ £140k and my mom was on ~ £35k and we were struggling with the prices of homes in the better areas of Aberdeen - it'd have to be over £250k.

In my head, £60k isn't 'rich', it's an achievable wage if you put in effort and are fairly smart. I'd personally consider 'rich' to be a much more exclusive club, where one can't simply imagine getting there as easily - I'd peg it at the top 0.1% of UK incomes.

Posted from TSR Mobile

In my head, £60k isn't 'rich', it's an achievable wage if you put in effort and are fairly smart. I'd personally consider 'rich' to be a much more exclusive club, where one can't simply imagine getting there as easily - I'd peg it at the top 0.1% of UK incomes.

Posted from TSR Mobile

The 'better areas of Aberdeen' aren't too typical, its got some of the most expensive housing outside central London.

If 0.1% of the UK is 'rich', what are the 0.1-1% bracket? What are the 1%-5% bracket?

Original post by Astronomical

I do believe it would silly to say that thousands of graduates in London are automatically rich upon starting their grad scheme jobs...

Being rich isn't about how much you earn, it's about how much you hold: land, property, art, business, etc. The salary is only a small portion of the picture.

Being rich isn't about how much you earn, it's about how much you hold: land, property, art, business, etc. The salary is only a small portion of the picture.

This is especially true in other countries like Jordan where you judge a person's level of wealth by how much land his/her family or he/she individually owns and where that land is.

Original post by Hal.E.Lujah

EDIT: Wait, I've just re-read your post and realised the confusion. You seem to have a fundamental misconstrue about how taxes work, and worse having quickly crunched your numbers for the fictional 'Benefit theevin' family you proposed I've realised you're just making it up as you go along. Thanks but no thanks. :hat2

Actually I'm right and you are wrong. Prepare to have your mind blown about how screwed up the UK benefit system is.

Family #1: 3 kids, and a single earner who works for minimum wage (£10,000 a year)

--------------------------------------------------------------------------------------------------------------------

After Tax+NI they get £9,754.72 net (check here: listentotaxman.com)

Now lets compute the benefits. There is a government calculator here: http://www.entitledto.co.uk/ . Going through that and assuming they are renting a place in London gives the following (all tax-free):

Working Tax Credit £3,269.90

Child Tax Credit: £8,803.80

Council Tax Support £860.00

Housing Benefit £12,250.69

Child Benefit £2,475.20

-----

Total Entitlements £27,659.59

So their net income (salary+benefits) is £37,414

Family #2: 3 kids, and a single earner who earns £40,000 a yaer

----------------------------------------------------------------------------------------------

They get £30,154 net after income tax + NI (check here: http://www.listentotaxman.com)

They dont get tax credits but they do get housing benefit and child benefit

Housing Benefit £6,874.69

Child Benefit £2,475.20

----

Total Entitlements £9,349.89

So their net income (salary+benefits) is £39,503

-------------------

In other words, if you earn £40k a year then you have £2,089 extra in your pocket at the end of the year compared to someone who works a minimum wage £10k/year job.

And yet people are claiming that £40k is 'rich'? You are barely out-earning a McDonalds worker.

(edited 9 years ago)

Original post by poohat

Actually I'm right and you are wrong. Prepare to have your mind blown about how screwed up the UK benefit system is.

Family #1: 3 kids, and a single earner who works for minimum wage (£10,000 a year)

--------------------------------------------------------------------------------------------------------------------

After Tax+NI they get £9,754.72 net (check here: listentotaxman.com)

Now lets compute the benefits. There is a government calculator here: http://www.entitledto.co.uk/ . Going through that and assuming they are renting a place in London gives the following (all tax-free):

Working Tax Credit £3,269.90

Child Tax Credit: £8,803.80

Council Tax Support £860.00

Housing Benefit £12,250.69

Child Benefit £2,475.20

-----

Total Entitlements £27,659.59

So their net income (salary+benefits) is £37,414

Family #2: 3 kids, and a single earner who earns £40,000 a yaer

----------------------------------------------------------------------------------------------

They get £30,154 net after income tax + NI (check here: http://www.listentotaxman.com)

They dont get tax credits but they do get housing benefit and child benefit

Housing Benefit £6,874.69

Child Benefit £2,475.20

----

Total Entitlements £9,349.89

So their net income (salary+benefits) is £39,503

-------------------

In other words, if you earn £40k a year then you have £2,089 extra in your pocket at the end of the year compared to someone who works a minimum wage £10k/year job.

And yet people are claiming that £40k is 'rich'? You are barely out-earning a McDonalds worker.

Family #1: 3 kids, and a single earner who works for minimum wage (£10,000 a year)

--------------------------------------------------------------------------------------------------------------------

After Tax+NI they get £9,754.72 net (check here: listentotaxman.com)

Now lets compute the benefits. There is a government calculator here: http://www.entitledto.co.uk/ . Going through that and assuming they are renting a place in London gives the following (all tax-free):

Working Tax Credit £3,269.90

Child Tax Credit: £8,803.80

Council Tax Support £860.00

Housing Benefit £12,250.69

Child Benefit £2,475.20

-----

Total Entitlements £27,659.59

So their net income (salary+benefits) is £37,414

Family #2: 3 kids, and a single earner who earns £40,000 a yaer

----------------------------------------------------------------------------------------------

They get £30,154 net after income tax + NI (check here: http://www.listentotaxman.com)

They dont get tax credits but they do get housing benefit and child benefit

Housing Benefit £6,874.69

Child Benefit £2,475.20

----

Total Entitlements £9,349.89

So their net income (salary+benefits) is £39,503

-------------------

In other words, if you earn £40k a year then you have £2,089 extra in your pocket at the end of the year compared to someone who works a minimum wage £10k/year job.

And yet people are claiming that £40k is 'rich'? You are barely out-earning a McDonalds worker.

Both people in your scenario are rich, because if you earn over £22,000, then are you in the top 1% of earners globally after accounting for Purchasing Power Parity (that is, after accounting for the lower cost of living in poorer countries).

Original post by Doctor_Einstein

Using this definition, a single adult in the UK is rich if they earn more than 31k per year.

Well compared to the majority of people in the UK, they are relatively 'well off'.

Original post by Hal.E.Lujah

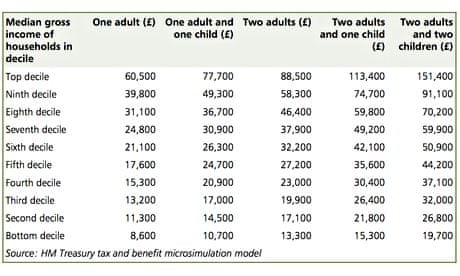

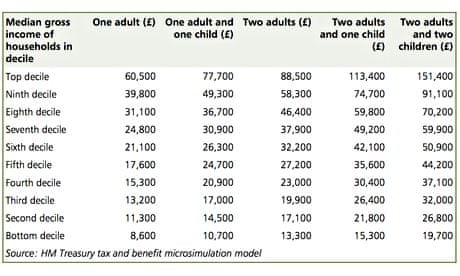

I also think I should probably link my source again. It accounts for single earners, dual earners, families, etc. Tax is missed, which is a tricky one as people at a certain threshold are banded lower, but overall I fail to see where the statistics from HMRC are flawed?

.

I also think I should probably link my source again. It accounts for single earners, dual earners, families, etc. Tax is missed, which is a tricky one as people at a certain threshold are banded lower, but overall I fail to see where the statistics from HMRC are flawed?

.

One misleading part of those statistics (aside from the fact it doesnt include tax+benefits) is that it isnt taking age into account. Most "two adult no children" households are going to either be young people (under 30 or so) or pensioners. Similarly most "one child" households are going to be in the 25-33 range, and most single-person households will be young single mothers or (again) pensioners.

If you want a picture of what a 'typical' adult earns in mid-career (rather than a pensioner or fresh graduate) then the "two adult two children" column will be the best approximation, which would mean a £90k household income makes you top 10%. That seems reasonable, but remember that after tax+benefits they will 'only' have £20-30k more per year net than £10k minimum wage family.

(edited 9 years ago)

Original post by Hal.E.Lujah

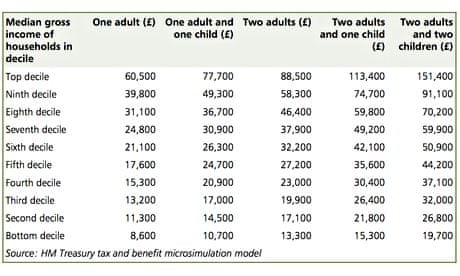

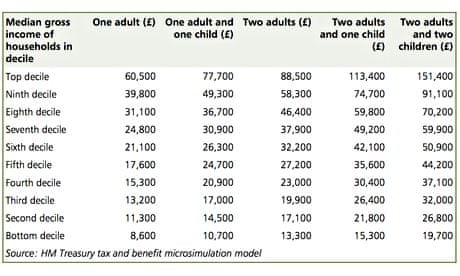

I also think I should probably link my source again. It accounts for single earners, dual earners, families, etc. Tax is missed, which is a tricky one as people at a certain threshold are banded lower, but overall I fail to see where the statistics from HMRC are flawed?

.

I also think I should probably link my source again. It accounts for single earners, dual earners, families, etc. Tax is missed, which is a tricky one as people at a certain threshold are banded lower, but overall I fail to see where the statistics from HMRC are flawed?

.

One misleading part of those statistics (aside from the fact it doesnt take the substantial amount of benefits income people get) is that it isnt taking age into account. Most "two adult no children" households are going to either be young people (under 30 or so) or pensioners. Similarly most "one child" households are going to be in the 25-33 range, and most single-person households will be young single mothers or (again) pensioners.

If you want a picture of what a 'typical' adult earns in mid-career (rather than a pensioner or fresh graduate) then the "two adult two children" column will be the best approximation, which would mean a £90k gross household income makes you top 10%. That seems reasonable, but remember that after tax+benefits they will 'only' have £20-30k more per year net than the £10k minimum wage family. Also if that is a dual income family then the chlid-care costs are likely to be very high, so you can probably take away £10-30k of their net income for that alone (a full time nanny in the south costs about £30k/year and you will almost certainly need one if you have 2 professional parents working full time) which means (again) that in practice they arent going to have much more disposable income than the minimum wage people.

For most of the population, the UK is basically communist - after your have children everyone who earns less than £50k basically has the same net income give or take a couple of thousand pounds, due to how the benefit system works. Its only once you cross the £60k mark that you start making more than the typical London family, and you really need to be making that as a single earner (rather than joint with your partner) or you will just lose it all on childcare costs.

I stand by my earlier comment that in practice £100k as a single earner is the minimum threshold where you could reasonably live a middle class life in the South.

(edited 9 years ago)

Original post by poohat

Actually I'm right and you are wrong. Prepare to have your mind blown about how screwed up the UK benefit system is.

Family #1: 3 kids, and a single earner who works for minimum wage (£10,000 a year)

--------------------------------------------------------------------------------------------------------------------

After Tax+NI they get £9,754.72 net (check here: listentotaxman.com)

Now lets compute the benefits. There is a government calculator here: http://www.entitledto.co.uk/ . Going through that and assuming they are renting a place in London gives the following (all tax-free):

Working Tax Credit £3,269.90

Child Tax Credit: £8,803.80

Council Tax Support £860.00

Housing Benefit £12,250.69

Child Benefit £2,475.20

-----

Total Entitlements £27,659.59

So their net income (salary+benefits) is £37,414

Family #2: 3 kids, and a single earner who earns £40,000 a yaer

----------------------------------------------------------------------------------------------

They get £30,154 net after income tax + NI (check here: http://www.listentotaxman.com)

They dont get tax credits but they do get housing benefit and child benefit

Housing Benefit £6,874.69

Child Benefit £2,475.20

----

Total Entitlements £9,349.89

So their net income (salary+benefits) is £39,503

-------------------

In other words, if you earn £40k a year then you have £2,089 extra in your pocket at the end of the year compared to someone who works a minimum wage £10k/year job.

And yet people are claiming that £40k is 'rich'? You are barely out-earning a McDonalds worker.

Family #1: 3 kids, and a single earner who works for minimum wage (£10,000 a year)

--------------------------------------------------------------------------------------------------------------------

After Tax+NI they get £9,754.72 net (check here: listentotaxman.com)

Now lets compute the benefits. There is a government calculator here: http://www.entitledto.co.uk/ . Going through that and assuming they are renting a place in London gives the following (all tax-free):

Working Tax Credit £3,269.90

Child Tax Credit: £8,803.80

Council Tax Support £860.00

Housing Benefit £12,250.69

Child Benefit £2,475.20

-----

Total Entitlements £27,659.59

So their net income (salary+benefits) is £37,414

Family #2: 3 kids, and a single earner who earns £40,000 a yaer

----------------------------------------------------------------------------------------------

They get £30,154 net after income tax + NI (check here: http://www.listentotaxman.com)

They dont get tax credits but they do get housing benefit and child benefit

Housing Benefit £6,874.69

Child Benefit £2,475.20

----

Total Entitlements £9,349.89

So their net income (salary+benefits) is £39,503

-------------------

In other words, if you earn £40k a year then you have £2,089 extra in your pocket at the end of the year compared to someone who works a minimum wage £10k/year job.

And yet people are claiming that £40k is 'rich'? You are barely out-earning a McDonalds worker.

30hrs a week isn't typical, although the point stands. They are both made poor by having dependent kids though. As a single earner they'd be well off (I wouldn't say rich, I'd say that was someone on £45-50k.

Original post by poohat

but remember that after tax+benefits they will 'only' have £20-30k more per year net than the £10k minimum wage family.

Also if that is a dual income family then the chlid-care costs are likely to be very high, so you can probably take away £10-30k of their net income for that alone (a full time nanny in the south costs about £30k/year and you will almost certainly need one if you have 2 professional parents working full time)

Also if that is a dual income family then the chlid-care costs are likely to be very high, so you can probably take away £10-30k of their net income for that alone (a full time nanny in the south costs about £30k/year and you will almost certainly need one if you have 2 professional parents working full time)

As you say 'only' represents median gross earnings in the UK.

Duel income doesn't mean full time. My boss has gross income of £38-40k from a 3.5 day week, her husband is a contractor on bucket loads, they have two young kids (4 and 7 I think) but don't use much child care, let alone a nanny.

Original post by poohat

Actually I'm right and you are wrong. Prepare to have your mind blown about how screwed up the UK benefit system is.

Family #1: 3 kids, and a single earner who works for minimum wage (£10,000 a year)

--------------------------------------------------------------------------------------------------------------------

After Tax+NI they get £9,754.72 net (check here: listentotaxman.com)

Now lets compute the benefits. There is a government calculator here: http://www.entitledto.co.uk/ . Going through that and assuming they are renting a place in London gives the following (all tax-free):

Working Tax Credit £3,269.90

Child Tax Credit: £8,803.80

Council Tax Support £860.00

Housing Benefit £12,250.69

Child Benefit £2,475.20

-----

Total Entitlements £27,659.59

So their net income (salary+benefits) is £37,414

Family #2: 3 kids, and a single earner who earns £40,000 a yaer

----------------------------------------------------------------------------------------------

They get £30,154 net after income tax + NI (check here: http://www.listentotaxman.com)

They dont get tax credits but they do get housing benefit and child benefit

Housing Benefit £6,874.69

Child Benefit £2,475.20

----

Total Entitlements £9,349.89

So their net income (salary+benefits) is £39,503

-------------------

In other words, if you earn £40k a year then you have £2,089 extra in your pocket at the end of the year compared to someone who works a minimum wage £10k/year job.

And yet people are claiming that £40k is 'rich'? You are barely out-earning a McDonalds worker.

Family #1: 3 kids, and a single earner who works for minimum wage (£10,000 a year)

--------------------------------------------------------------------------------------------------------------------

After Tax+NI they get £9,754.72 net (check here: listentotaxman.com)

Now lets compute the benefits. There is a government calculator here: http://www.entitledto.co.uk/ . Going through that and assuming they are renting a place in London gives the following (all tax-free):

Working Tax Credit £3,269.90

Child Tax Credit: £8,803.80

Council Tax Support £860.00

Housing Benefit £12,250.69

Child Benefit £2,475.20

-----

Total Entitlements £27,659.59

So their net income (salary+benefits) is £37,414

Family #2: 3 kids, and a single earner who earns £40,000 a yaer

----------------------------------------------------------------------------------------------

They get £30,154 net after income tax + NI (check here: http://www.listentotaxman.com)

They dont get tax credits but they do get housing benefit and child benefit

Housing Benefit £6,874.69

Child Benefit £2,475.20

----

Total Entitlements £9,349.89

So their net income (salary+benefits) is £39,503

-------------------

In other words, if you earn £40k a year then you have £2,089 extra in your pocket at the end of the year compared to someone who works a minimum wage £10k/year job.

And yet people are claiming that £40k is 'rich'? You are barely out-earning a McDonalds worker.

I actually feel sick after reading this. Benefits are beyond a joke. Is there any wonder we have a benefit culture when, realistically, most people will never out-earn somebody earning min. wage? Where is the motivation meant to come from to even get that £40k job which will obviously be more stressful than some ****ty £10k job... I despair.

Original post by Astronomical

I actually feel sick after reading this. Benefits are beyond a joke. Is there any wonder we have a benefit culture when, realistically, most people will never out-earn somebody earning min. wage? Where is the motivation meant to come from to even get that £40k job which will obviously be more stressful than some ****ty £10k job... I despair.

Could you give an example of them not out earning?

Int he example you quoted, the person on £40k was out earning them.

Original post by Quady

Could you give an example of them not out earning?

Int he example you quoted, the person on £40k was out earning them.

Int he example you quoted, the person on £40k was out earning them.

Let me rectify my comment: significantly out-earn.

I do not believe that working what is almost certainly in most cases a far more stressful job is worth only a £2000 net increase in takehome pay.

Original post by Astronomical

Let me rectify my comment: significantly out-earn.

I do not believe that working what is almost certainly in most cases a far more stressful job is worth only a £2000 net increase in takehome pay.

I do not believe that working what is almost certainly in most cases a far more stressful job is worth only a £2000 net increase in takehome pay.

For me, I don't find my job which pays over £40k more stressful than when I was opening/closing a petrol station at 6am/11pm when I was making less than £10k. That might not be representative but I'm not convinced there is much in it.

I think its also worth noting that the example had £12k+ for housing benefit as it was in the context of London. Someone on £40k in London isn't all that high up the chain.

If we assume that I'm the only earner with 3 children then I'd say that a salary of 90k would make me rich by my on standards. In terms of household income if there's a second earner then 120k.

My own ambition is a personal salary of 50k or a household income of 70k.

Worth noting though that your investments and assets are what will make you rich, not your income.

My own ambition is a personal salary of 50k or a household income of 70k.

Worth noting though that your investments and assets are what will make you rich, not your income.

Quick Reply

Related discussions

- how can i get a grade 9 on this english literature essay?

- Is earning 25k a year considered poor?

- my eng literature notes (grade 7/8) (gsce 2022)

- P45

- Durham Uni Law offer, should I accept?

- London gcse english poetry

- AQA GCSE English Literature Paper 1 (8702/1) - 13th May 2024 [Exam Chat]

- Politics 25 mark extract question structure

- How much money do I need in order to be attractive?

- macbet practice answer

- whats the nicest car a 17 year old could get insured on?

- Footballers aren't overpaid

- Merchant of Venice Quotes

- capped mark of zero

- If you think you will be rich as a dentist you're mistaken (I'm an associate Dentist)

- Guardian - UK middle classes ‘struggling despite incomes of up to £60,000 a year’

- Post Your Favourite Inspirational Quotes :)

- Online opportunities to earn money

- a level english lit DOAS analysis

- Could someone grade my GCSE English Lit essay?

Latest

Trending

Last reply 1 week ago

I think I have a Cifas Marker on my name , can I still open any banks ?Last reply 3 weeks ago

Has anyone had their student finance paid into their partners or parents bank?Last reply 1 month ago

Introduction to UK Financial regulations and professional integrity SCAMTrending

Last reply 1 week ago

I think I have a Cifas Marker on my name , can I still open any banks ?Last reply 3 weeks ago

Has anyone had their student finance paid into their partners or parents bank?Last reply 1 month ago

Introduction to UK Financial regulations and professional integrity SCAM