This discussion is now closed.

Check out other Related discussions

- Is the UK prepared for WW3?

- why is life so unfair? why do privileged people think of themselves higher?

- law - Lnat essay - space exploration

- Lnat essay review - Space exploration

- Why does the UK not use the gold standard

- OCR A level History

- Is Computer Science the next 'useless' degree?

- 18 in year 12

- We are all screwed

- Housing crisis

- Explain Liss truss policies to me

- Rishi Sunak considering banning cigarettes for the next generation

- Crypto and bitcoin - any purpose and use beyond their plethora of scams and frauds?

- OCR A Level Geography Human interactions H481/02 - 8 Jun 2022 [Exam Chat]

- What financial support is there available around placements?

- Post Your Economics Question Here

- Have the Tories stopped being Conservative?

- Absolutely furious with the NHS

- What do you think of HS2 only going to Birmingham

- Are communists stupid?

Why Can't the Government Create Money?

Scroll to see replies

The only thing stopping Government from taking back control of our money supply is the whole American Military. London is basically the money laundering capital of the world. If we where to take power away from our Banks we would also be sanctioned right away by the US.

If you have any idea how Putin was raised to power your realize he kicked out all our the oligarchs who had huge wealth in Russia. As a consequence of doing so Russia was branded as the big bad monster.

If you have any idea how Putin was raised to power your realize he kicked out all our the oligarchs who had huge wealth in Russia. As a consequence of doing so Russia was branded as the big bad monster.

Original post by BigItch

Some governments have done this by using quantitative easing there are some problems with it. One of the problems being that if you print too much it devalues money this is because it manufactures inflation which was never there to start with.

I've recieved this type of response throughout the thread. The problem is that it has zero explanatory power. You mention that there are some problems with creating and issuing money debt-free, then go on to mention only one problem which is highly abstract and barely original in content. The government could flood the economy with money, but that money wouldn't necessarily cause inflation if it is spent on a whole range of public projects, infrastructure and services that stimulate aggregate demand, since money spent on productive activities increases supply alongside demand. The only constraint on government spending that there ought to be are the physical constraints of nature, of human capital and of raw material; and the electorate can then exercise their democratic right in voicing their wishes and needs for funding, whatever that may be.

The creative power unleashed by the ability to simply create and issue money without a corresponding debt is extraordinary; a near utopia would be absolutely possible. The primary obstacle is the private banking industry who create money in the form of debt through their lending practices and cause asset-price inflation in the speculative property and financial markets. National governments have been completely subordinated to the private banking industry, when in fact the power ought to be in the reverse.

(edited 8 years ago)

Original post by stemmery

Hyperinflation?

I depend what the money is spent on and if it goes into the real economy.

A good example of hyperinflation arguably by private banks and what not to do is house prices. Who basically throw money at a limited resource.

If you spend the money on something that will generate a demand in the economy for example infrastructure for example if we have a large scale nuclear power program which are my favourite example we can create a product everyone wants - electricity this increase the real economy mean the money does not change the value of each pound so it isn't inflationary.

Have a look at how money works:

http://positivemoney.org/how-money-works/how-banks-create-money/

The question I believe this forum (at the minimum) is asking is why does the government borrow money from banks which create it out of nothing but charges us for interest for essentially what are IOUs. When the government can do exactly the same as the banks but without the interest. Then if their is a real problem with inflation it can take money out of circulation via taxation.

Original post by Quady

Who owns the shares?

I thought there was only owner of the shares - the Treasury Solicitor.

I thought there was only owner of the shares - the Treasury Solicitor.

The Rothschild family.

Original post by #Ridwan

The Rothschild family.

*yawn*

No other jewz?

Original post by BigItch

Some governments have done this by using quantitative easing there are some problems with it. One of the problems being that if you print too much it devalues money this is because it manufactures inflation which was never there to start with.

Weird how inflation is so low then...

Original post by Quady

Weird how inflation is so low then...

if you print loads of money it will make money worthless and bump up inflation you're a cretin if you think otherwise

Original post by Quady

Weird how inflation is so low then...

He refers to asset-price inflation in the financial markets, which is where QE was aimed.

I've come to realise that the term inflation is just a buzzword employed by those who either lack understanding of the current monetary system (which actively creates asset-price inflation) or ideologically choose to avoid rational discussion.

The following post is a perfect example.

Original post by BigItch

if you print loads of money it will make money worthless and bump up inflation you're a cretin if you think otherwise

Not only does he opt not to respond to my explanation, but continues ideologically to repeat the same line rote learned from an incredibly abstract summary of how inflation works, devoid of any understanding comprising real economic functions and the monetary system.

(edited 8 years ago)

Original post by Polymath0

He refers to asset-price inflation in the financial markets, which is where QE was aimed.

I've come to realise that the term inflation is just a buzzword employed by those who either lack understanding of the current monetary system (which actively creates asset-price inflation) or ideologically choose to avoid rational discussion.

The following post is a perfect example.

Not only does he opt not to respond to my explanation, but continues ideologically to repeat the same line rote learned from incredibly abstract summary of how inflations works, devoid of any understanding comprising real economic functions and the monetary system.

I've come to realise that the term inflation is just a buzzword employed by those who either lack understanding of the current monetary system (which actively creates asset-price inflation) or ideologically choose to avoid rational discussion.

The following post is a perfect example.

Not only does he opt not to respond to my explanation, but continues ideologically to repeat the same line rote learned from incredibly abstract summary of how inflations works, devoid of any understanding comprising real economic functions and the monetary system.

It can only be limited though it will cause inflation if you keep doing it.

It can and it does.

Original post by BigItch

It can only be limited though it will cause inflation if you keep doing it.

What can only be limited? Who can limit it? What is "it?" Keep doing what? It would be helpful if you could express yourself clearer and more precisely. Otherwise there's no need for you to enter the thread.

Original post by Little Toy Gun

It can and it does.

I kindly refuse to take seriously such a display of assertion in the absence of argument or evidence. I assume you haven't even taken the effort to read the opening post.

Original post by Polymath0

What can only be limited? Who can limit it? What is "it?" Keep doing what? It would be helpful if you could express yourself clearer and more precisely. Otherwise there's no need for you to enter the thread.

I kindly refuse to take seriously such a display of assertion in the absence of argument or evidence. I assume you haven't even taken the effort to read the opening post.

I kindly refuse to take seriously such a display of assertion in the absence of argument or evidence. I assume you haven't even taken the effort to read the opening post.

I have as much rights as you so I will tell you politely to start with if you don't like what i post you know where to go

Original post by Polymath0

He refers to asset-price inflation in the financial markets, which is where QE was aimed.

Like oil and gold huh?

Original post by BigItch

if you print loads of money it will make money worthless and bump up inflation you're a cretin if you think otherwise

Can you explain the lack of inflation right now?

If not, you're calling yourself a cretin.

because of this:

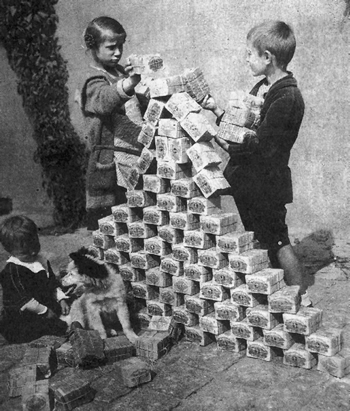

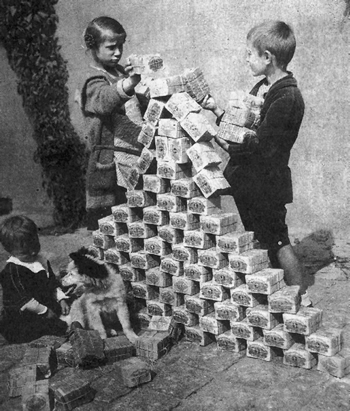

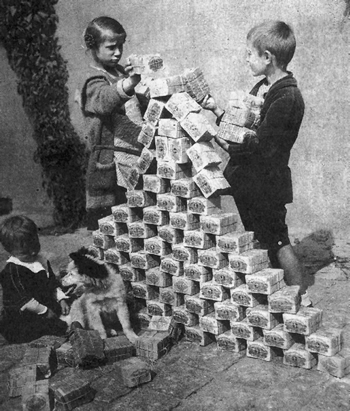

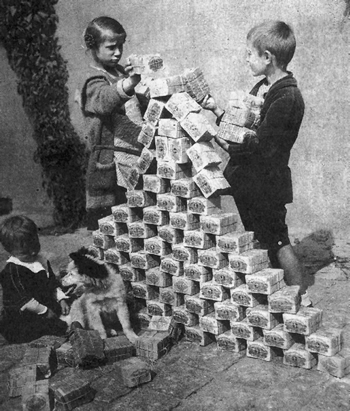

printing more money = inflation = money devalues = more money printed = inflation etc

printing more money = inflation = money devalues = more money printed = inflation etc

Original post by CoolCavy

because of this:

printing more money = inflation = money devalues = more money printed = inflation etc

printing more money = inflation = money devalues = more money printed = inflation etc

Only in extreme cases. Inflation is not inherently bad.

Original post by United1892

Only in extreme cases. Inflation is not inherently bad.

true, it isn't bad for savers and investors but for the average person the excess printing of money would be a problem

Original post by CoolCavy

true, it isn't bad for savers and investors but for the average person the excess printing of money would be a problem

How is inflation not bad for savers and investors?

Inflation hits their return.

Its good for borrowers not savers.

Original post by CoolCavy

true, it isn't bad for savers and investors but for the average person the excess printing of money would be a problem

Normally wages rise more than inflation so it's fine it lowers debts buts cuts into savings. The alternative of deflation is worse.

Related discussions

- Is the UK prepared for WW3?

- why is life so unfair? why do privileged people think of themselves higher?

- law - Lnat essay - space exploration

- Lnat essay review - Space exploration

- Why does the UK not use the gold standard

- OCR A level History

- Is Computer Science the next 'useless' degree?

- 18 in year 12

- We are all screwed

- Housing crisis

- Explain Liss truss policies to me

- Rishi Sunak considering banning cigarettes for the next generation

- Crypto and bitcoin - any purpose and use beyond their plethora of scams and frauds?

- OCR A Level Geography Human interactions H481/02 - 8 Jun 2022 [Exam Chat]

- What financial support is there available around placements?

- Post Your Economics Question Here

- Have the Tories stopped being Conservative?

- Absolutely furious with the NHS

- What do you think of HS2 only going to Birmingham

- Are communists stupid?

Latest

Trending

Last reply 2 days ago

Even Europe’s far-right firebrands seem to sense Brexit is a disaster- The GuardianLast reply 3 days ago

Why is the political left now censorious and authoritarian??Last reply 5 days ago

Sunak rejects offer of youth mobility scheme between EU and UKLast reply 2 weeks ago

Rayner denies wrongdoing over council house sale amid police reviewLast reply 2 weeks ago

TSR Goes Green: How important will the environment be in this year's election?Last reply 3 weeks ago

TSR Big Discussion #1: What should be top priority to protect the environment?Last reply 3 weeks ago

Where do you stand on the political spectrum (8values)? – Take a quiz here!Last reply 3 weeks ago

2024 UK general election speculation and build-up threadLast reply 3 weeks ago

No progress made on half of UK government’s levelling-up targetsLast reply 3 weeks ago

Trump needs a $464m bond in six days. What if he can't get it?Trending

Last reply 2 days ago

Even Europe’s far-right firebrands seem to sense Brexit is a disaster- The GuardianLast reply 3 days ago

Why is the political left now censorious and authoritarian??Last reply 5 days ago

Sunak rejects offer of youth mobility scheme between EU and UKLast reply 2 weeks ago

Rayner denies wrongdoing over council house sale amid police reviewLast reply 2 weeks ago

TSR Goes Green: How important will the environment be in this year's election?Last reply 3 weeks ago

TSR Big Discussion #1: What should be top priority to protect the environment?Last reply 3 weeks ago

Where do you stand on the political spectrum (8values)? – Take a quiz here!Last reply 3 weeks ago

2024 UK general election speculation and build-up threadLast reply 3 weeks ago

No progress made on half of UK government’s levelling-up targetsLast reply 3 weeks ago

Trump needs a $464m bond in six days. What if he can't get it?