Petition to STOP student loans going down

Sorry if this is the wrong forum but this is my first time posting! My sister just sent me this petition, apparently student loans aren't rising with inflation and you'll be losing £1,500.

https://petition.parliament.uk/petitions/632022

I'm meant to be starting uni in September and I know student loans aren't meant to be a lot, but this seems crazy?? My parents are already supporting my sister so I don't know if they'll be able to support me too, but hopefully if enough people sign this the government will increase the loan.

https://petition.parliament.uk/petitions/632022

I'm meant to be starting uni in September and I know student loans aren't meant to be a lot, but this seems crazy?? My parents are already supporting my sister so I don't know if they'll be able to support me too, but hopefully if enough people sign this the government will increase the loan.

(edited 1 year ago)

Original post by bakedbens

Sorry if this is the wrong forum but this is my first time posting! My sister just sent me this petition, apparently student loans aren't rising with inflation and you'll be losing £1,500.

https://petition.parliament.uk/petitions/632022

I'm meant to be starting uni in September and I know student loans aren't meant to be a lot, but this seems crazy?? My parents are already supporting my sister so I don't know if they'll be able to support me too, but hopefully if enough people sign this the government will increase the loan.

https://petition.parliament.uk/petitions/632022

I'm meant to be starting uni in September and I know student loans aren't meant to be a lot, but this seems crazy?? My parents are already supporting my sister so I don't know if they'll be able to support me too, but hopefully if enough people sign this the government will increase the loan.

Most people's salaries are not rising with inflation either, meaning most people have less money with which to live (in real terms) this year than last. Why should students be protected from the cost-of-living crisis?

Original post by DataVenia

Most people's salaries are not rising with inflation either, meaning most people have less money with which to live (in real terms) this year than last. Why should students be protected from the cost-of-living crisis?

My sister and her friends have always said the student loan isn't enough, so if it's going down even more, surely some people won't be able to get by?

Also I know that benefits and pensions are both going up with inflation, so why shouldn't student loans?

Original post by bakedbens

My sister and her friends have always said the student loan isn't enough, so if it's going down even more, surely some people won't be able to get by?

Also I know that benefits and pensions are both going up with inflation, so why shouldn't student loans?

Also I know that benefits and pensions are both going up with inflation, so why shouldn't student loans?

This is true.

Inflation-linked benefits and tax credits will rise by 10.1% from April 2023, in line with the Consumer Prices Index (CPI) rate of inflation in September 2022. Similarly, pensions are currently subject to the "triple lock", meaning that they are guaranteed to rise in line with the higher of CPI (as at September 2022), average earnings between May 2022 and July 2022, or 2.5 per cent. So these will raise by 10.1% in April too. Students are seeing the maximum maintenance loan increasing by just 2.8%.

So why shouldn't student loans increase by 10.1% too? I don't know what argument the Government would put forward here, but I suspect it's simply that they have less of a "voice" then those claiming benefits and pensioners:

(a) There are 2.66 million students at UK higher education institutions (mostly studying first degrees; figures from 2021/21 figures) (source). As of February 2022, 22 million people were claiming some form of benefits*, in England, Scotland and Wales (source). As of February 2022, the number of people receiving State Pension was 12.5 million. (source)

(b) Across the last three general elections, of those in the 18-24 age group (which most students will be), only about 50% voted; for those in the 65-74 and 75+ age groups (which most pensioners will be), in excess of 80% voted. Of the other age groups average about 70% voted (source).

So, the group who received a 10.1% increase is comprised of 32.5 million people, 70-80% of whom vote. The group who received a 2.8% increase is comprised of 2.66 million students, about 50% of whom vote. (Correlation is not the same as causation.)

* I realise that not all 22 million benefit claimants will see their benefits increase by 10.1%, as only those benefits which are inflation-linked are increasing by that amount. However, I couldn't be bothered to work out which are inflation-linked and which aren't, and then lookup-the stats per benefit, avoiding counting the same claimants twice.

Original post by DataVenia

This is true.

Inflation-linked benefits and tax credits will rise by 10.1% from April 2023, in line with the Consumer Prices Index (CPI) rate of inflation in September 2022. Similarly, pensions are currently subject to the "triple lock", meaning that they are guaranteed to rise in line with the higher of CPI (as at September 2022), average earnings between May 2022 and July 2022, or 2.5 per cent. So these will raise by 10.1% in April too. Students are seeing the maximum maintenance loan increasing by just 2.8%.

So why shouldn't student loans increase by 10.1% too? I don't know what argument the Government would put forward here, but I suspect it's simply that they have less of a "voice" then those claiming benefits and pensioners:

(a) There are 2.66 million students at UK higher education institutions (mostly studying first degrees; figures from 2021/21 figures) (source). As of February 2022, 22 million people were claiming some form of benefits*, in England, Scotland and Wales (source). As of February 2022, the number of people receiving State Pension was 12.5 million. (source)

(b) Across the last three general elections, of those in the 18-24 age group (which most students will be), only about 50% voted; for those in the 65-74 and 75+ age groups (which most pensioners will be), in excess of 80% voted. Of the other age groups average about 70% voted (source).

So, the group who received a 10.1% increase is comprised of 32.5 million people, 70-80% of whom vote. The group who received a 2.8% increase is comprised of 2.66 million students, about 50% of whom vote. (Correlation is not the same as causation.)

* I realise that not all 22 million benefit claimants will see their benefits increase by 10.1%, as only those benefits which are inflation-linked are increasing by that amount. However, I couldn't be bothered to work out which are inflation-linked and which aren't, and then lookup-the stats per benefit, avoiding counting the same claimants twice.

Inflation-linked benefits and tax credits will rise by 10.1% from April 2023, in line with the Consumer Prices Index (CPI) rate of inflation in September 2022. Similarly, pensions are currently subject to the "triple lock", meaning that they are guaranteed to rise in line with the higher of CPI (as at September 2022), average earnings between May 2022 and July 2022, or 2.5 per cent. So these will raise by 10.1% in April too. Students are seeing the maximum maintenance loan increasing by just 2.8%.

So why shouldn't student loans increase by 10.1% too? I don't know what argument the Government would put forward here, but I suspect it's simply that they have less of a "voice" then those claiming benefits and pensioners:

(a) There are 2.66 million students at UK higher education institutions (mostly studying first degrees; figures from 2021/21 figures) (source). As of February 2022, 22 million people were claiming some form of benefits*, in England, Scotland and Wales (source). As of February 2022, the number of people receiving State Pension was 12.5 million. (source)

(b) Across the last three general elections, of those in the 18-24 age group (which most students will be), only about 50% voted; for those in the 65-74 and 75+ age groups (which most pensioners will be), in excess of 80% voted. Of the other age groups average about 70% voted (source).

So, the group who received a 10.1% increase is comprised of 32.5 million people, 70-80% of whom vote. The group who received a 2.8% increase is comprised of 2.66 million students, about 50% of whom vote. (Correlation is not the same as causation.)

* I realise that not all 22 million benefit claimants will see their benefits increase by 10.1%, as only those benefits which are inflation-linked are increasing by that amount. However, I couldn't be bothered to work out which are inflation-linked and which aren't, and then lookup-the stats per benefit, avoiding counting the same claimants twice.

I 100% agree with everything you've said, but surely this is exactly why students/anyone who cares about students needs to fight this?

If the issue is that students won't get what they need because they don't have enough of a voice, surely a big part of the solution is doing things like signing this petition (and voting obv).

Original post by bakedbens

I 100% agree with everything you've said, but surely this is exactly why students/anyone who cares about students needs to fight this?

If the issue is that students won't get what they need because they don't have enough of a voice, surely a big part of the solution is doing things like signing this petition (and voting obv).

If the issue is that students won't get what they need because they don't have enough of a voice, surely a big part of the solution is doing things like signing this petition (and voting obv).

Agreed. That's why I signed the petition earlier today.

Original post by DataVenia

Agreed. That's why I signed the petition earlier today.

Lol that's great, hopefully more people can get involved!

Original post by DataVenia

Most people's salaries are not rising with inflation either, meaning most people have less money with which to live (in real terms) this year than last. Why should students be protected from the cost-of-living crisis?

Because it is a loan. So will be paid back.

Original post by Timbaker

Because it is a loan. So will be paid back.

Well, sort of.

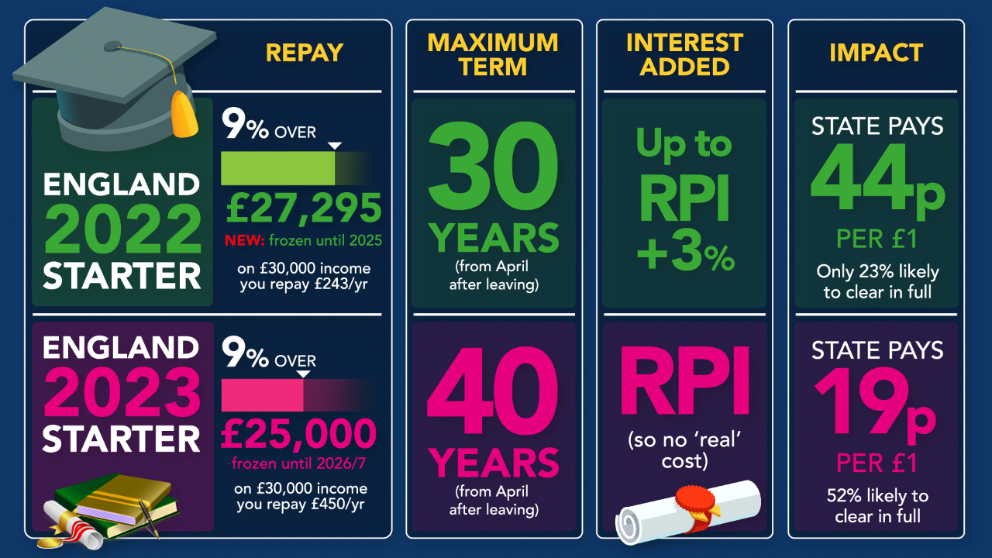

If we're talking about Plan 2 (for those who started their course between 1 September 2012 and 31 July 2023), then only 23% are likely to clear their loan in full - with the state paying 44p per £1. If we're talking about Plan 5 (for those starting their course on or after 1 August 2023) then 52% are likely to clear their loan in full - with the state paying 19p per £1.

Now apply those expected rates of loan clearance with the value of outstanding loans (from Student Loan Statistics, published by the House of Commons Library, 4 July 2023):

"Currently £20 billion per year is loaned to around 1.5 million higher education students in England each year. The value of outstanding loans at the end of March 2023 reached £206 billion. The Government forecasts the value of outstanding loans to reach around £460 billion (2021-22 prices) by the mid-2040s."

So it's not really a loan in the traditional sense, where you borrow £X and pay back £X plus interest.

Quick Reply

Related discussions

- Ensure fair grading for GCSE and A Level students in 2023 (Government Petition)

- Are student loans in the UK halal?

- Need help please

- Please help signing this petition

- Please help signing this PETITION !

- Only allowed to take 8 GCSE's

- I'm thinking of taking out a bank loan

- Student Loan Query

- Student finance urgent help

- Petition rules? (Will be for vet student loan rules)

- Keeping the cost of eating out down in London?

- Student Finance

- dropping out of open university?

- Commuting from Preston to Lancaster

- Student Finance for postgrad

- Uni is so expensive - should i take a year out and reapply?

- How long does it take for the money to come to ur bank account after approval?

- Important PSA for disabled students on ESA & UC

- Student Loan

- Convincing parents to let you move for University?!

Latest

Trending

Last reply 3 weeks ago

Got a third in my second year and the highest I’ve achieved in third year was 55%Trending

Last reply 3 weeks ago

Got a third in my second year and the highest I’ve achieved in third year was 55%